What is TRADED in FOREX?

The simple answer is MONEY. Specifically, currencies.

Because you’re not buying anything physical, forex trading can be confusing so we’ll use a simple (but imperfect) analogy to help explain.Think of buying a currency as buying a share in a particular country, kinda like buying shares in a company. The price of the currency is usually a direct reflection of the market’s opinion on the current and future health of its respective economy.

Traders can either buy (go long) or sell (go short) a currency pair. If a trader expects the base currency to strengthen against the quote currency, they will buy the pair.

Conversely, if they anticipate the base currency weakening, they will sell the pair. Profits and losses are realized based on the direction of price movements.

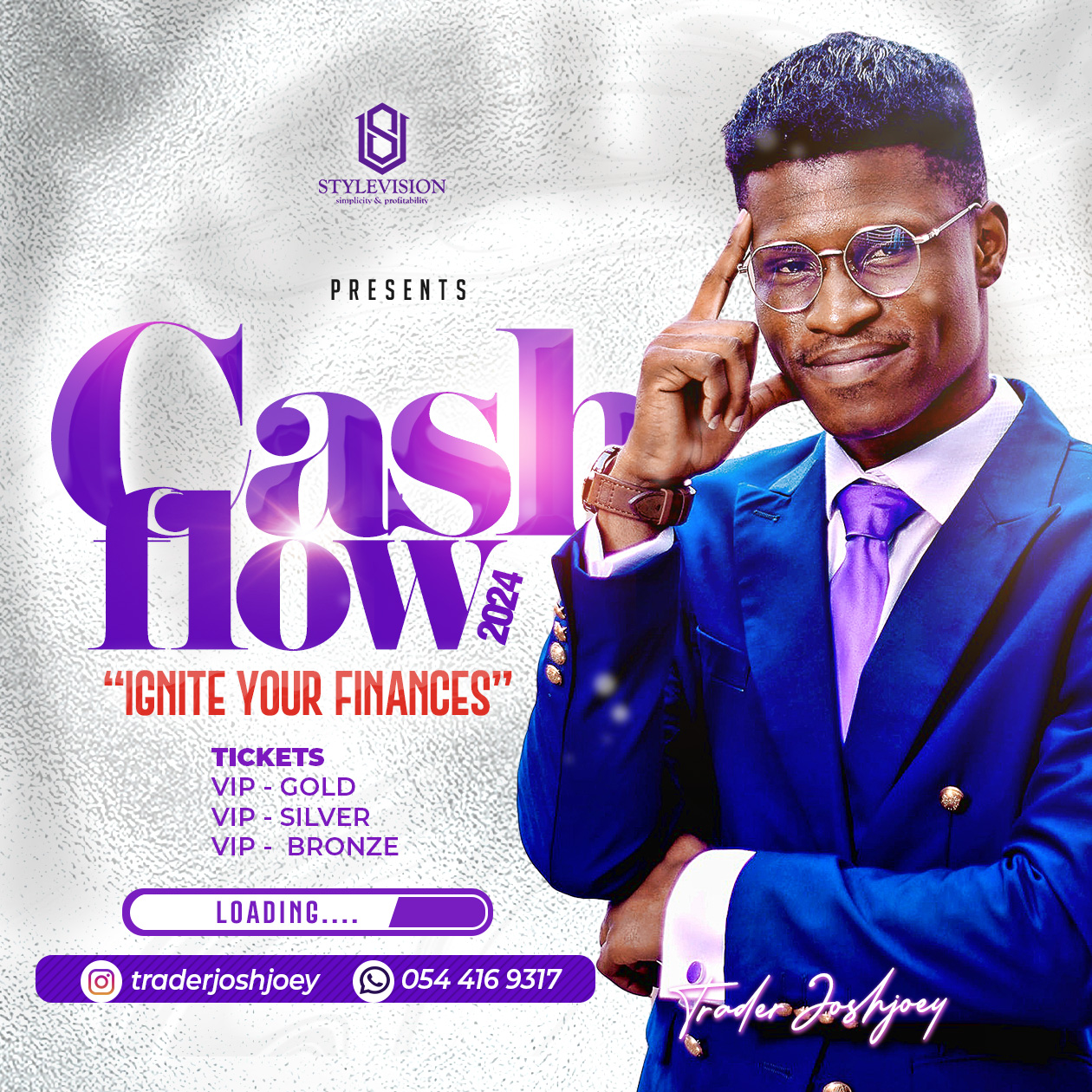

Join our trading community- Click image below

Currency Pairs

Currencies from countries all over the world are traded in the forex market. The most commonly traded currency pairs include major currencies such as the U.S. Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and others.

In forex trading, currency pairs are fundamental components, representing the relationship between two currencies. Understanding currency pairs is crucial for traders as they navigate the market. Here are more details about currency pairs:

-

Base and Quote Currencies:

- Base Currency: The first currency in the pair is the base currency. It represents the unit of measurement for the exchange rate. For example, in the EUR/USD pair, the Euro (EUR) is the Base currency.

- Quote Currency: The second currency in the pair is the quote currency. It expresses the value of one unit of the base currency in terms of the quote currency. In the EUR/USD pair, the U.S. Dollar (USD) is the Quote currency.

- Currency Pair Notation:

- Currency pairs are typically denoted in a three-letter code, where the first two letters represent the country, and the third letter signifies the currency. For example, USD stands for the United States Dollar, and EUR stands for the Euro.

-

-

Major, Minor, and Exotic Pairs:

- Major Pairs: Major pairs include the most traded currencies globally and involve the U.S. Dollar. Examples are EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs (Cross-Currency Pairs): These pairs don't include the U.S. Dollar but involve other major currencies. Examples are EUR/GBP, AUD/JPY, and GBP/JPY.

- Exotic Pairs: Exotic pairs involve one major currency and one currency from a smaller or emerging economy. Examples include USD/TRY (U.S. Dollar/Turkish Lira) and EUR/SEK (Euro/Swedish Krona).

-

Currency Pair Relationships:

- The exchange rate of a currency pair tells you how much of the quote currency you need to spend to purchase one unit of the base currency. For example, if the EUR/USD pair has an exchange rate of 1.15, it means 1 Euro is equivalent to 1.15 U.S. Dollars.

-

Bid and Ask Prices:

- The bid price represents the maximum price a buyer is willing to pay for the currency pair, while the ask price is the minimum price a seller is willing to accept. The difference between these two prices is known as the spread.

-

Currency Pair Volatility:

- Different currency pairs exhibit varying levels of volatility. Major pairs are generally more stable, while exotic pairs may experience higher volatility due to the smaller and less liquid markets of the involved currencies.

-

Cross Rates:

- A cross rate involves a currency pair that does not include the U.S. Dollar. For example, if you trade the Euro against the Japanese Yen (EUR/JPY), without involving the U.S. Dollar, it is considered a cross rate.

-

Pip and Pipette:

- A pip (percentage in point) is a standard unit of movement in forex trading. Most currency pairs are quoted to four decimal places. A pipette is the fifth decimal place in exchange rates.

Understanding these aspects of currency pairs is essential for effective forex trading. Traders analyze the relationships between different currencies to make informed decisions based on market trends, economic indicators, and geopolitical events.

-

What is Currency trading?

Forex trading is the simultaneous buying of one currency and selling of another.

Currencies are traded through a broker or “CFD provider” and are traded in pairs. Currencies are quoted in relation to another currency.

Next Lesson Lessons 1 2 3 4 5 6 7 8 ...