LESSON 7

MARKET TRENDS

A trend in the financial markets refers to the general direction in which the price of an asset is moving. Traders and investors analyze trends to make informed decisions about buying or selling assets. Trends are typically identified by observing the patterns formed by an asset's price movements over time. There are three main types of trends:

-

Uptrend:

- An uptrend is characterized by a series of higher highs and higher lows.

- It indicates that the overall direction of the market is upward.

- Buyers are in control, and there is a general optimism about the asset.

-

Downtrend:

- A downtrend is characterized by a series of lower highs and lower lows.

- It indicates that the overall direction of the market is downward.

- Sellers are in control, and there is a general pessimism about the asset.

-

Sideways or Range-bound Trend:

- In a sideways or range-bound trend, the price moves within a horizontal range.

- There is no clear upward or downward direction.

- Buyers and sellers are in a state of equilibrium, and the market is consolidating.

UPTREND MARKET

-

Higher Highs:

- In an uptrend, each peak (high) in the price is higher than the previous one.

- This suggests increasing buying momentum and a willingness of traders to pay higher prices for the asset.

-

Higher Lows:

- Along with higher highs, the lows in an uptrend are also higher than the previous lows.

- Higher lows indicate that, even during pullbacks or corrections, buyers are stepping in at higher price levels, demonstrating continued bullish sentiment.

-

Overall Upward Direction:

- The sequence of higher highs and higher lows collectively establishes an upward trajectory for the asset's price.

- The overall movement is positive, reflecting an optimistic outlook on the asset.

-

Buyers in Control:

- In an uptrend, buyers dominate the market. There is a higher demand for the asset, leading to upward price movement.

- This dominance can be attributed to positive economic indicators, favorable news, or other factors that attract investors.

-

General Optimism:

- The presence of an uptrend generally creates a positive sentiment among market participants.

- Traders and investors are optimistic about the asset's future performance, and there is a belief that the trend will continue.

It's important for traders to recognize and confirm the presence of an uptrend through technical analysis before making decisions. Various technical indicators, such as trendlines, moving averages, and oscillators, can be used to identify and validate trends. Understanding the prevailing market trend is a fundamental aspect of developing effective trading strategies.

DOWNTREND MARKET

-

Lower Highs:

- In a downtrend, each peak (high) in the price is lower than the previous one.

- Lower highs indicate a diminishing willingness of traders to buy at higher price levels.

-

Lower Lows:

- Alongside lower highs, the lows in a downtrend are also lower than the previous lows.

- Lower lows suggest that, even during brief bounces or corrections, sellers are entering the market at lower price levels, reflecting sustained bearish sentiment.

-

Overall Downward Direction:

- The sequence of lower highs and lower lows collectively establishes a downward trajectory for the asset's price.

- The overall movement is negative, signaling a bearish trend.

-

Sellers in Control:

- In a downtrend, sellers dominate the market. There is an increased supply of the asset, leading to downward price movement.

- This dominance can be attributed to negative economic indicators, adverse news, or other factors that prompt investors to sell.

-

General Pessimism:

- The presence of a downtrend generally creates a pessimistic sentiment among market participants.

- Traders and investors are cautious, and there is a belief that the trend will persist or intensify.

Recognizing a downtrend is crucial for traders as it helps inform their trading strategies. Similar to uptrends, technical analysis tools and indicators can be employed to identify and confirm downtrends. Understanding the prevailing market trend is a key component of successful trading, as it allows traders to align their strategies with the market's momentum.

SIDEWAYS - TREND MARKET

-

Horizontal Range:

- In a sideways or range-bound trend, the price fluctuates within a horizontal band or range.

- The upper and lower bounds of the range are relatively flat, indicating a lack of a clear upward or downward trend.

-

No Clear Direction:

- Unlike uptrends or downtrends, there is no distinct and sustained movement in either the upward or downward direction.

- Price movements within the range are often characterized by oscillations or fluctuations without a strong bias.

-

Buyers and Sellers in Equilibrium:

- The market is in a state of equilibrium, meaning that the forces of supply and demand are roughly balanced.

- Buyers and sellers are evenly matched, leading to a lack of a decisive trend.

-

Consolidation:

- Sideways trends are often referred to as periods of consolidation, where the market is taking a breather after a previous trend.

- This consolidation phase can precede a potential breakout or breakdown, where the market transitions into a new trend.

Understanding a sideways or range-bound market is important for traders because it signals a different set of conditions compared to trending markets. In a ranging market, traders might employ different strategies, such as range trading or mean reversion strategies, which aim to capitalize on the price moving within a defined range. Additionally, traders may use technical indicators like support and resistance levels to identify potential breakout or breakdown points when the market eventually exits the range.

Duration of Trends:

Trends can also be classified based on their duration, which helps traders determine the time frame they are analyzing. The three main classifications are:

-

Short-term Trends:

- Last for a few days to a few weeks.

- Often influenced by short-term market events, news, or technical factors.

-

Intermediate Trends:

- Last for several weeks to several months.

- Reflect a combination of short-term events and medium-term economic factors.

-

Long-term Trends:

- Last for several months to years.

- Driven by fundamental economic factors, structural changes, and long-term investor sentiment.

LESSON 8

TIME FRAMES - CANDLESTICKS CHART

In Forex trading, candlestick charts are widely used to visualize price movements. Candlestick charts provide valuable information about the open, high, low, and close prices for a specific time period. Traders can choose different timeframes for their candlestick charts based on their trading style and preferences. Here are some common timeframes used in Forex trading:

1-Minute Chart:

- Each candlestick represents one minute of price movement.

- Suitable for day traders and those who want to capture very short-term price fluctuations.

-

High Frequency of Trades:

- The 1-minute chart is characterized by a high frequency of candlestick formations, given that each candlestick represents just one minute of price action.

- This makes it suitable for day traders who execute trades within short timeframes and capitalize on intraday price movements.

-

Quick Decision-Making:

- Traders using 1-minute charts need to make rapid decisions based on the information presented in each candlestick.

- This timeframe is suitable for those who are comfortable with quick market analysis and execution.

-

Volatility and Noise:

- Due to its short timeframe, the 1-minute chart can be more susceptible to market noise and short-term price fluctuations.

- Traders need to be aware of the increased volatility and be able to distinguish between meaningful price movements and random market noise.

-

Scalping Opportunities:

- Scalpers, who aim to make small profits from very short-term price movements, often use the 1-minute chart to identify quick entry and exit points.

It's important for traders to be aware of the challenges associated with very short-term trading. Market conditions can change rapidly, and the 1-minute chart requires a high level of attention and discipline. Additionally, transaction costs, including spreads and commissions, can become more significant when trading at such short intervals. As with any trading timeframe, having a well-defined strategy, risk management plan, and sufficient market understanding is crucial for success.

5-Minute Chart:

- Each candlestick represents five minutes of price movement.

- Common among day traders and those looking for slightly longer-term trends.

-

Timeframe and Candlestick Duration:

- In a 5-minute chart, each candlestick represents a 5-minute time interval.

- This timeframe provides a broader view compared to the 1-minute chart, allowing traders to observe price movements over slightly longer periods.

-

Day Trading and Short-Term Trends:

- The 5-minute chart is popular among day traders who want to capture short-term trends and make quicker decisions compared to longer timeframes.

- It strikes a balance between the precision of the 1-minute chart and the broader perspective of longer timeframes.

-

Identification of Short-Term Trends:

- Traders using the 5-minute chart aim to identify and capitalize on short-term trends and market fluctuations within the same trading day.

- This timeframe is suitable for those who prefer more data than the 1-minute chart but still want relatively quick insights.

-

Reduced Noise Compared to Shorter Timeframes:

- While still providing relatively quick insights, the 5-minute chart may exhibit reduced noise compared to shorter timeframes like the 1-minute chart.

- Traders can potentially filter out some of the short-term market fluctuations.

-

Multiple Trades in a Day:

- Day traders on a 5-minute chart might execute multiple trades during a trading session, reacting to the evolving market conditions.

-

Technical Analysis and Indicators:

- Traders often use technical analysis tools and indicators suitable for short-term trends, such as moving averages, trendlines, and short-term oscillators.

-

Risk Management:

- Effective risk management is crucial, as positions may still be opened and closed relatively quickly.

- Traders need to set appropriate stop-loss orders and manage their risk in line with the volatility of the 5-minute timeframe.

The 5-minute chart provides a balance for traders who want to participate in day trading activities but seek a bit more context than the very short-term precision of the 1-minute chart. It's a versatile timeframe that caters to those looking for a middle ground in terms of time horizon and decision-making speed.

15-Minute Chart:

- Each candlestick represents 15 minutes of price movement.

- Suitable for day traders and swing traders looking for short to medium-term trends.

-

Timeframe and Candlestick Duration:

- In a 15-minute chart, each candlestick represents a 15-minute time interval.

- This timeframe provides traders with a balance between the precision of shorter timeframes and the broader perspective of longer timeframes.

-

Day Trading and Swing Trading:

- The 15-minute chart is well-suited for both day traders and swing traders.

- Day traders may use it to capture intraday trends, while swing traders can employ it to identify trends that last from a few hours to a couple of days.

-

Short to Medium-Term Trends:

- Traders using the 15-minute chart can effectively analyze and trade short to medium-term trends.

- This timeframe provides more data points than the 5-minute chart, allowing for a more extended observation of price movements.

-

Reduced Noise Compared to Shorter Timeframes:

- The 15-minute chart generally exhibits reduced noise compared to even shorter timeframes.

- Traders may find it easier to identify meaningful price movements and trends while filtering out some of the shorter-term fluctuations.

-

Decision-Making and Analysis:

- Traders using the 15-minute chart have a bit more time for decision-making compared to even shorter timeframes.

- Technical analysis tools and indicators suitable for short to medium-term trends are commonly applied.

-

Swing Trading Opportunities:

- Similar to the 30-minute chart, the 15-minute chart provides swing traders with opportunities to identify and capitalize on price swings occurring over a few hours to a couple of days.

-

Risk Management:

- Effective risk management remains crucial, especially for day traders who may open and close positions within a single trading day.

- Swing traders using the 15-minute chart also need to manage risk over a slightly longer timeframe.

The 15-minute chart serves as a flexible and popular choice for traders seeking to balance the need for precision with the desire for a more extended analysis of price movements. As always, the selection of a timeframe should align with a trader's strategy, goals, and risk tolerance.

30-Minute Chart:

Each candlestick represents 30 minutes of price movement.

Suitable for day traders and swing traders looking for short to medium-term trends.

-

Timeframe and Candlestick Duration:

- In a 30-minute chart, each candlestick represents a 30-minute time interval.

- This timeframe provides a broader view compared to the 5-minute chart, allowing traders to observe price movements over a more extended period.

-

Day Trading and Swing Trading:

- The 30-minute chart is versatile and is used by both day traders and swing traders.

- Day traders might use it for capturing shorter-term trends within the same trading day, while swing traders may use it for identifying trends that last a few hours to a couple of days.

-

Medium-Term Trends:

- The 30-minute chart allows traders to identify and analyze short to medium-term trends.

- It provides a balance between the intraday precision of shorter timeframes and the broader perspective of longer timeframes.

-

Reduced Noise Compared to Shorter Timeframes:

- Similar to the 5-minute chart, the 30-minute chart may exhibit reduced noise compared to shorter timeframes.

- Traders can potentially filter out some of the short-term market fluctuations.

-

Decision-Making and Analysis:

- Traders using the 30-minute chart have a bit more time for decision-making compared to shorter timeframes.

- Technical analysis, trendlines, and indicators suitable for short to medium-term trends are often employed.

-

Swing Trading Opportunities:

- Swing traders may use the 30-minute chart to identify and capitalize on price swings that occur over a few hours to a couple of days.

-

Risk Management:

- Effective risk management is crucial, especially for day traders who may still open and close positions within a single trading day.

- Swing traders also need to manage risk over a slightly longer timeframe.

The 30-minute chart is a popular choice for traders who want to balance the desire for quick insights with the need for a bit more context and analysis. It provides a useful timeframe for those looking to engage in both day trading and swing trading activities. As always, choosing a timeframe should align with a trader's strategy, preferences, and risk tolerance.

1-Hour Chart:

- Each candlestick represents one hour of price movement.

- Popular among swing traders and those who want to capture trends over several hours.

-

Timeframe and Candlestick Duration:

- In a 1-hour chart, each candlestick represents a 1-hour time interval.

- This timeframe provides traders with a broader view compared to shorter timeframes, allowing for a more extended analysis of price movements.

-

Swing Trading:

- The 1-hour chart is particularly popular among swing traders.

- Swing traders use this timeframe to identify and capitalize on trends that last from a few hours to several days.

-

Medium-Term Trends:

- Traders using the 1-hour chart are focused on analyzing and trading medium-term trends.

- The longer duration of each candlestick allows for a smoother representation of price movements and trends.

-

Reduced Noise and Increased Context:

- Compared to shorter timeframes, the 1-hour chart typically exhibits reduced noise.

- Traders may find it easier to identify significant trends and potential reversal points with the additional context provided by each candlestick.

-

Decision-Making and Analysis:

- Traders on the 1-hour chart have more time for decision-making compared to shorter timeframes.

- Technical analysis tools and indicators suitable for medium-term trends are often applied.

-

Swing Trading Opportunities:

- The 1-hour chart provides swing traders with ample opportunities to identify and participate in trends that unfold over several hours to a couple of days.

-

Risk Management:

- Effective risk management remains crucial for traders using the 1-hour chart.

- Swing traders need to manage risk over a slightly longer timeframe, considering the duration of the trends they are targeting.

-

Aligning with Daily and Weekly Trends:

- Traders on the 1-hour chart often consider aligning their trades with the broader daily and weekly trends for additional confirmation.

The 1-hour chart offers a good compromise between shorter intraday timeframes and longer-term perspectives. It's a popular choice for swing traders who want to capture trends over a more extended period while avoiding some of the noise associated with shorter timeframes. As always, the selection of a timeframe should align with a trader's strategy, goals, and risk tolerance.

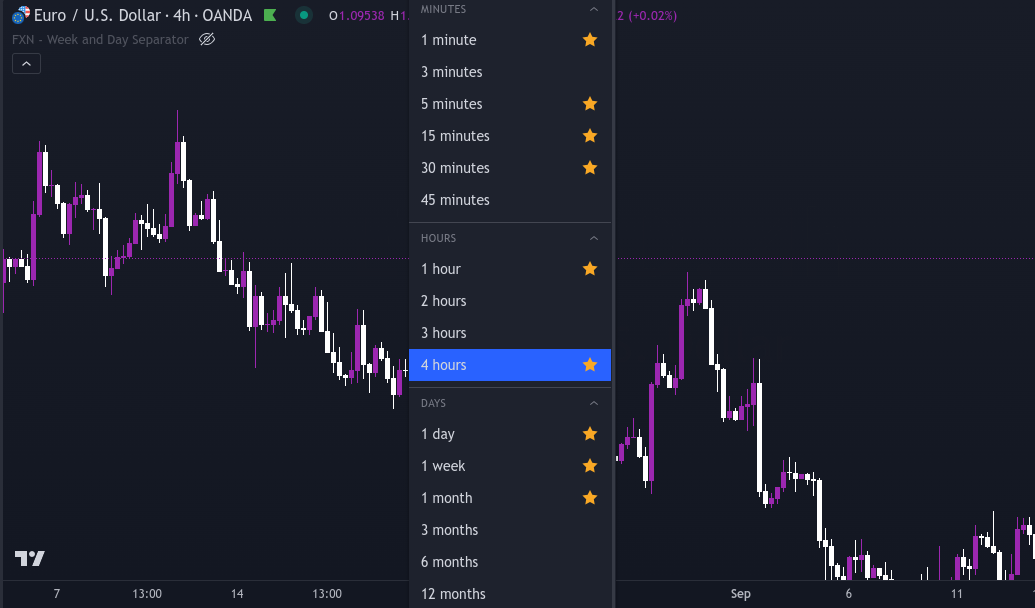

4-Hour Chart:

- Each candlestick represents four hours of price movement.

- Used by swing traders and those who want a broader view of the market.

-

Timeframe and Candlestick Duration:

- In a 4-hour chart, each candlestick represents a 4-hour time interval.

- This timeframe provides traders with an even more extended view compared to the 1-hour chart, allowing for a broader analysis of price movements.

-

Swing Trading:

- The 4-hour chart is prominently used by swing traders.

- Swing traders analyze trends and make trading decisions with a focus on capturing moves that span several days to weeks.

-

Medium to Long-Term Trends:

- Traders using the 4-hour chart are focused on identifying and participating in medium to long-term trends.

- The longer duration of each candlestick helps smooth out short-term noise and emphasizes more significant price movements.

-

Reduced Noise:

- Compared to shorter timeframes, the 4-hour chart tends to exhibit reduced noise.

- Traders may find it easier to identify more significant trends and key levels of support and resistance.

-

Decision-Making and Analysis:

- Traders using the 4-hour chart have more time for decision-making compared to shorter intraday timeframes.

- Technical analysis tools and indicators suitable for medium to long-term trends are often applied.

-

Longer-Term Market View:

- The 4-hour chart allows traders to take a longer-term view of the market, helping them align their trades with broader trends.

-

Swing Trading Opportunities:

- The 4-hour chart provides swing traders with ample opportunities to identify and participate in trends that unfold over several days to weeks.

-

Risk Management:

- Effective risk management remains crucial for traders using the 4-hour chart.

- Swing traders need to manage risk over a more extended timeframe, considering the duration of the trends they are targeting.

The 4-hour chart is popular among swing traders who want to avoid the noise of shorter timeframes while still maintaining a focus on medium to long-term trends. It offers a balance between the shorter intraday timeframes and the longer-term perspectives provided by daily or weekly charts. As with any timeframe, the choice should align with a trader's strategy, goals, and risk tolerance.

Daily Chart:

- Each candlestick represents one full day of price movement.

- Suitable for swing traders and investors with a medium to long-term perspective.

-

Timeframe and Candlestick Duration:

- In a daily chart, each candlestick represents a full day of trading activity.

- This timeframe provides traders and investors with a comprehensive view of price movements over a more extended period.

-

Swing Trading and Investment:

- The daily chart is frequently used by swing traders and investors.

- Swing traders may use daily charts to capture trends that last from several days to weeks, while investors analyze longer-term trends and make decisions based on a more extended horizon.

-

Medium to Long-Term Trends:

- Traders and investors using the daily chart are focused on identifying and participating in medium to long-term trends.

- The longer duration of each candlestick helps smooth out short-term fluctuations and emphasizes more significant price movements.

-

Reduced Noise and Enhanced Trends:

- Compared to shorter timeframes, the daily chart significantly reduces noise.

- It provides a clearer picture of the overall trend, making it easier to identify key levels of support and resistance.

-

Decision-Making and Analysis:

- Traders and investors on the daily chart have ample time for decision-making and analysis.

- Fundamental analysis, alongside technical analysis, may play a more significant role due to the longer timeframe.

-

Long-Term Market View:

- The daily chart allows for a long-term view of the market, which is valuable for investors looking to make strategic decisions based on broader economic trends and fundamentals.

-

Swing Trading and Investment Opportunities:

- The daily chart provides both swing traders and investors with ample opportunities to identify and participate in trends that unfold over weeks, months, or even years.

-

Risk Management:

- Effective risk management is crucial for traders and investors using the daily chart.

- Longer timeframes necessitate a different approach to risk management, considering the extended duration of trades.

The daily chart is a key timeframe for those seeking to analyze and trade the market with a medium to long-term perspective. It's particularly suitable for investors making strategic decisions and swing traders capturing trends that unfold over a more extended period. As with any timeframe, the choice should align with a trader's or investor's strategy, goals, and risk tolerance.

Weekly Chart:

- Each candlestick represents one week of price movement.

- Used by long-term investors and those analyzing longer-term trends.

-

Timeframe and Candlestick Duration:

- In a weekly chart, each candlestick represents a full week of trading activity.

- This timeframe provides a macroscopic view of price movements, offering a long-term perspective.

-

Long-Term Investing:

- The weekly chart is primarily used by long-term investors.

- Investors often analyze this timeframe to make strategic decisions based on broader economic trends and fundamentals.

-

Analysis of Longer-Term Trends:

- Traders and investors using the weekly chart are focused on identifying and participating in longer-term trends.

- The extended duration of each candlestick helps filter out short-term noise and emphasizes major price movements.

-

Reduced Noise and Enhanced Trends:

- Compared to shorter timeframes, the weekly chart significantly reduces noise.

- It provides a clearer picture of the overall trend, facilitating the identification of key support and resistance levels.

-

Decision-Making and Fundamental Analysis:

- Traders and investors on the weekly chart have considerable time for decision-making and analysis.

- Fundamental analysis plays a more prominent role, as investors make strategic decisions based on broader economic trends and long-term fundamentals.

-

Very Long-Term Market View:

- The weekly chart allows for an extended, very long-term view of the market.

- Investors can make decisions with a horizon that spans several months to years.

-

Long-Term Investment Opportunities:

- The weekly chart provides long-term investors with opportunities to identify and participate in trends that unfold over months and years.

-

Risk Management:

- Effective risk management is crucial for traders and investors using the weekly chart.

- Given the extended duration of trades, risk management strategies may differ from those employed in shorter timeframes.

The weekly chart is a key tool for long-term investors who wish to take a strategic approach to their investments. It allows for a deep analysis of longer-term trends and is valuable for those seeking to make decisions based on a more extended investment horizon. As always, the choice of timeframe should align with the investor's strategy, goals, and risk tolerance.

Monthly Chart:

- Each candlestick represents one month of price movement.

- Primarily used by long-term investors and for analyzing macro trends.

-

Timeframe and Candlestick Duration:

- In a monthly chart, each candlestick represents a full month of trading activity.

- This timeframe provides an even more macroscopic view of price movements, offering an extended and strategic perspective.

-

Long-Term Investing:

- The monthly chart is predominantly used by long-term investors.

- Investors analyze this timeframe to make strategic decisions based on broader economic trends, long-term fundamentals, and extended market cycles.

-

Analysis of Macro Trends:

- Traders and investors using the monthly chart are focused on identifying and participating in macro trends.

- The extensive duration of each candlestick helps filter out short-term noise and emphasizes major, long-term price movements.

-

Reduced Noise and Enhanced Macro Trends:

- Compared to shorter timeframes, the monthly chart significantly reduces noise.

- It provides an exceptionally clear picture of the overall trend, facilitating the identification of key long-term support and resistance levels.

-

Decision-Making and Fundamental Analysis:

- Traders and investors on the monthly chart have ample time for decision-making and in-depth fundamental analysis.

- Fundamental analysis plays a crucial role, as investors make strategic decisions based on extensive economic trends and very long-term fundamentals.

-

Very Long-Term Market View:

- The monthly chart allows for an extremely long-term view of the market.

- Investors can make decisions with a horizon that spans several years to decades.

-

Very Long-Term Investment Opportunities:

- The monthly chart provides long-term investors with opportunities to identify and participate in trends that unfold over multiple years.

-

Risk Management:

- Effective risk management is crucial for traders and investors using the monthly chart.

- Given the exceptionally extended duration of trades, risk management strategies may differ significantly from those employed in shorter timeframes.

The monthly chart is a powerful tool for investors with a very long-term horizon. It's particularly useful for those seeking to make strategic decisions based on comprehensive economic trends and extremely long-term fundamentals. As with any timeframe, the choice should align with the investor's strategy, goals, and risk tolerance.

NOTE;

Traders often choose timeframes based on their trading strategy, time availability, and the duration of their intended trades. Shorter timeframes may be suitable for day trading and scalping, while longer timeframes are often used for swing trading and position trading. It's important for traders to select a timeframe that aligns with their trading goals and risk tolerance. Additionally, using multiple timeframes can provide a more comprehensive view of the market and help traders make well-informed decisions.