LESSON 4

FOREX ANALYSIS

Forex analysis involves examining and interpreting data to make informed decisions about trading currency pairs. There are three primary types of forex market analysis:

-

Technical Analysis:

- Definition: Technical analysis involves studying historical price charts, patterns, and various technical indicators to predict future price movements. It assumes that historical price movements and patterns tend to repeat themselves, and traders use this information to make decisions.

- Tools: Technical analysts use tools like charts, trendlines, support and resistance levels, moving averages, and oscillators (e.g., RSI, MACD) to identify potential entry and exit points.

- Key Concepts: Trends, chart patterns (e.g., head and shoulders, triangles), and support/resistance levels are crucial in technical analysis.

-

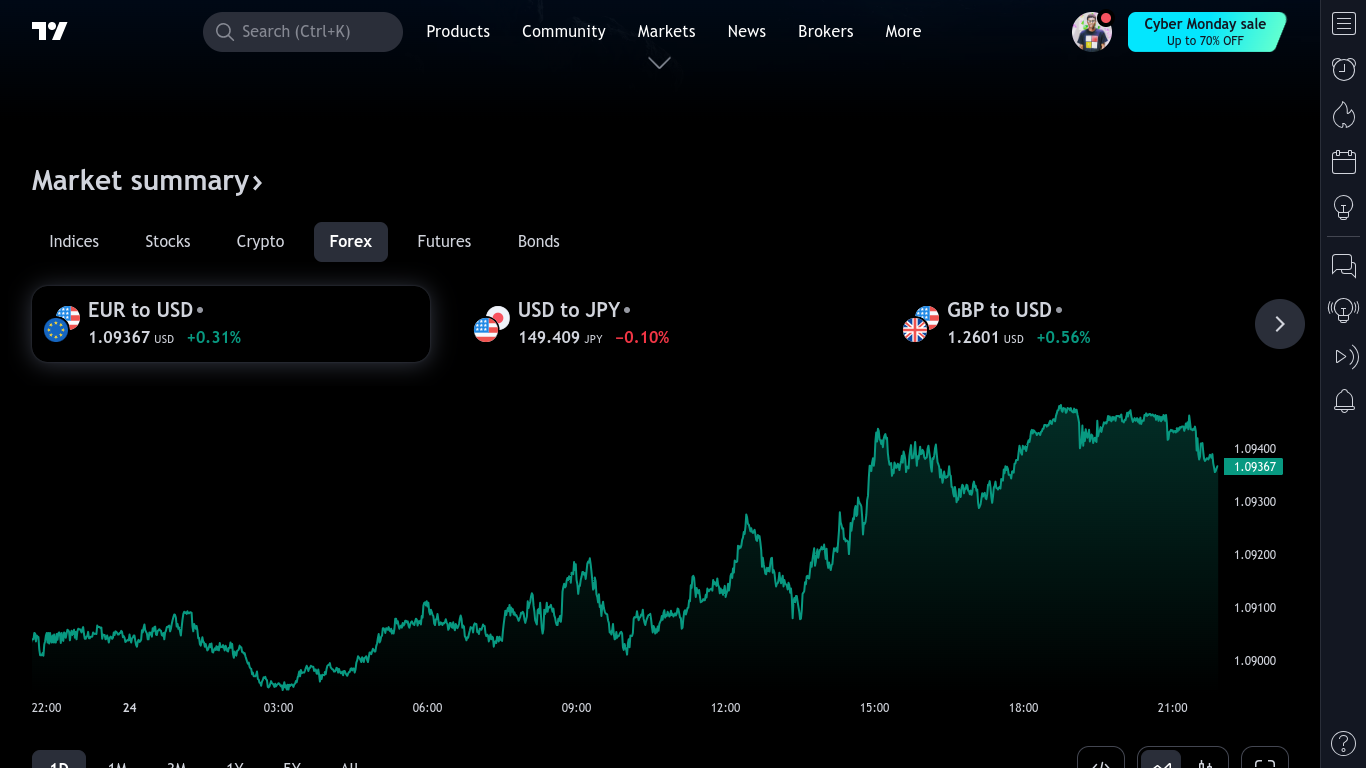

TradingView:

1. TradingView is a popular web-based platform that provides advanced charting tools and social networking for traders.

2. It offers a wide range of technical indicators, drawing tools, and customizable chart layouts.

3. Traders can analyze multiple asset classes, including forex, stocks, cryptocurrencies, and more.

4. The platform's interactive features allow traders to share ideas, analysis, and strategies with the trading community.

-

Fundamental Analysis:

- Definition: Fundamental analysis involves evaluating economic, social, and political factors that may affect currency values. Traders analyze economic indicators, government policies, and geopolitical events to make predictions about currency movements.

- Indicators: Key economic indicators include GDP growth, interest rates, inflation, employment data, and trade balances. Central bank policies and geopolitical developments are also significant factors.

- Impact on Currency Values: Positive economic indicators and stable political environments often lead to a stronger currency, while negative indicators or uncertainty can weaken a currency.

-

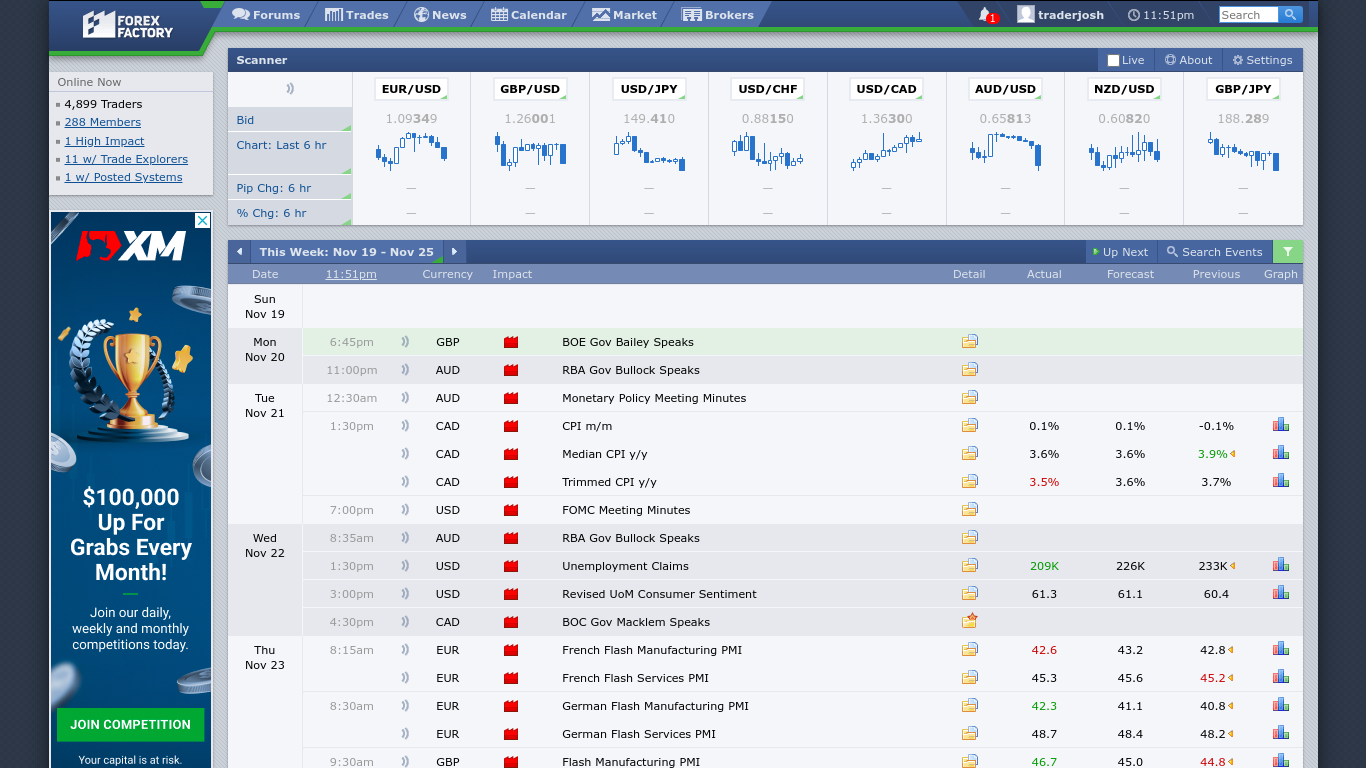

Forex Factory:

1. Forex Factory is a well-known online forum and platform that provides economic calendars, news releases, and trading discussions.

2. Traders can keep track of economic events, central bank announcements, and other news that can impact currency markets.

3. The forum also enables traders to share insights, analysis, and trading experiences with a large community of forex enthusiasts.

-

Sentiment Analysis:

- Definition: Sentiment analysis assesses the overall mood or sentiment of traders in the market. It gauges whether traders are generally bullish (expecting prices to rise) or bearish (expecting prices to fall).

- Indicators: Sentiment is often measured through tools like the Commitment of Traders (COT) report, which shows the positions of large traders, and sentiment indicators from retail trading platforms.

- Contrarian Approach: Some traders use sentiment analysis in a contrarian manner. For example, if the majority of traders are bullish, a contrarian might interpret this as a signal that the market is overly optimistic and may be due for a reversal.

-

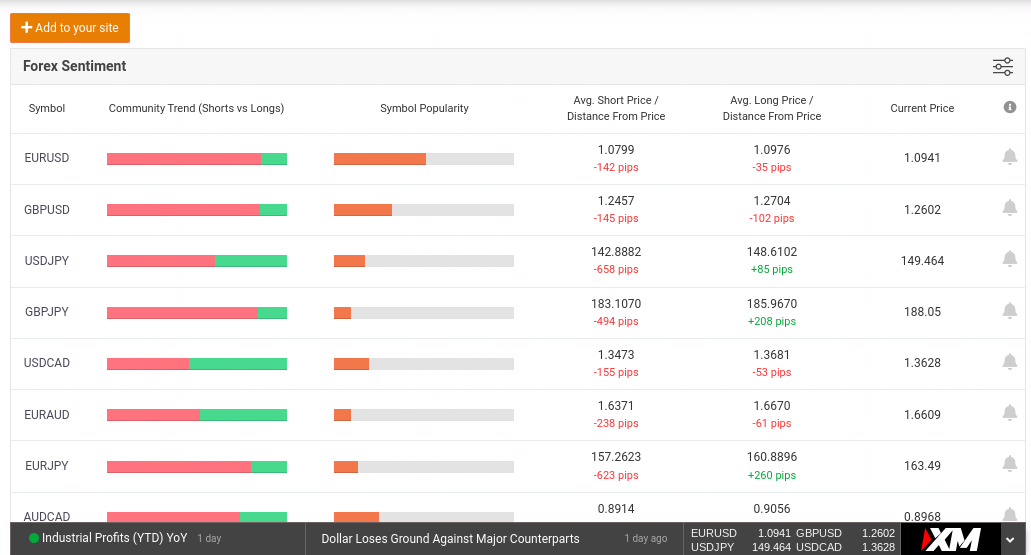

Myfxbook

1. Myfxbook is a platform that allows traders to track, analyze, and share their trading performance.

2. While Myfxbook is primarily known for tracking trading results, it also offers sentiment analysis features that provide insights into traders' collective positioning and market sentiment.

3. The sentiment analysis can help traders gauge the broader market sentiment and make informed trading decisions.

Traders often use a combination of these analyses to form a comprehensive view of the market. The choice between technical, fundamental, and sentiment analysis depends on the trader's preferences, trading style, and the time horizon of their trades. Many successful traders integrate multiple types of analysis to make more informed decisions.