Retail Traders: These are regular people like you who trade forex from their computers or phones. They're small players in the big market.

Banks: Big banks play a huge role. They trade huge amounts of money for themselves and their customers. They can influence exchange rates.

Corporations: Companies that do business in different countries also trade currencies. They might need to exchange money to pay for imports or receive payments.

Governments: Governments might trade currencies to control their own money's value. They can use this to influence their economy.

Investors: People and organizations that invest money in forex to try and make a profit. They could be big investment firms or individuals.

Brokers: These are like middlemen. They connect retail traders to the big forex market. Retail traders use brokers' platforms to trade.

Hedge Funds: These are like big investment groups. They manage a lot of money and trade currencies to make profits for their clients.

Central Banks: These are the banks of each country. They can influence exchange rates by controlling their country's money supply.

So, imagine it's like a big playground where people and groups are trading different kinds of money. Each one has their reasons and strategies for trading, and they all together make up the forex market. Here is the TYPE OF TRADERS:

Here are some common types of traders:

Scalpers: Scalpers are traders who make very quick trades, often holding positions for just a few seconds to a few minutes. They aim to profit from small price movements and usually make many trades throughout the day.

Day Traders: Day traders open and close trades within the same trading day. They don't hold positions overnight. Their goal is to capture short-term price movements.

Swing Traders: Swing traders hold trades for a few days to a few weeks, aiming to profit from medium-term price trends. They analyze both technical and fundamental factors.

Position Traders: Position traders have a long-term approach. They hold trades for weeks, months, or even years. They focus on fundamental analysis and broader market trends.

Scalp Swing Traders: These traders combine aspects of scalping and swing trading. They make several trades a day, looking for small gains but also considering longer-term trends.

Algorithmic (Algo) Traders: Algo traders use computer algorithms to execute trades automatically based on predefined rules. These rules can include technical indicators, patterns, and other criteria.

Copy Traders: Copy traders mimic the trades of more experienced traders. They follow the strategies of others, hoping to replicate their success.

Fundamental Traders: These traders focus on economic indicators, news, and events that influence currency values. They analyze macroeconomic factors to make trading

decisions.

Technical Traders: Technical traders rely on charts, patterns, and technical indicators to predict price movements. They believe historical price data can help predict future trends.

Join our trading community- Click image below

LESSON 2

BROKERAGE FIRMS

A brokerage firm in forex trading, often simply referred to as a "forex broker," is a financial institution or company that acts as an intermediary between individual traders and the foreign exchange market. Forex brokers provide traders with access to the forex market, allowing them to buy and sell currency pairs. Here's how brokerage firms work in forex trading:

Market Access:Forex brokers provide traders with a trading platform that connects to the global forex market. This platform allows traders to execute trades, monitor charts, and manage their accounts.

Execution of Trades: When a trader places an order to buy or sell a currency pair, the forex broker executes the trade on their behalf. The broker matches the trader's order with a counterparty, which could be another trader, a bank, or a liquidity provider.

Leverage and Margin: Brokers often offer leverage, allowing traders to control a larger position with a smaller amount of capital (margin). Leverage amplifies both profits

and losses.

Spread: Brokers earn revenue by charging traders a spread, which is the difference between the buying (ask) price and the selling (bid) price of a currency pair. This spread is their compensation for facilitating trades.

Platform and Tools: Forex brokers provide trading platforms and tools that allow traders to analyze the market, use technical indicators, and manage their trades effectively.

Account Types: Brokers offer various types of accounts, catering to different trading styles and capital levels. These can include demo accounts for practice and real accounts for live trading.

Regulation and Safety: Reputable forex brokers are regulated by financial authorities in their respective countries. Regulation helps ensure a certain level of transparency and security for traders.

Educational Resources: Many brokers provide educational materials, webinars, and resources to help traders learn about forex trading.

Customer Support: Brokers offer customer support to assist traders with account-related questions, technical issues, and trading inquiries.

It's important to choose a trustworthy and well-regulated forex broker to ensure a safe and reliable trading experience. Traders should research brokers, compare their

offerings, and consider factors like spreads, leverage, trading platforms, and customer service before making a decision.

CREATE your secured FOREX ACCOUNT(click here)

TOOLS & PLATFORMS

Tools and platforms that traders often use in forex trading:

MetaTrader 4/5 (MT4/5):

1. MetaTrader 5 is a popular trading platform that offers advanced charting, technical analysis, and automated trading capabilities.

2. It supports trading in forex, stocks, commodities, and other financial instruments.

3. MT5 includes built-in indicators, scripts, and expert advisors

(EAs) that traders can use to automate their trading strategies.

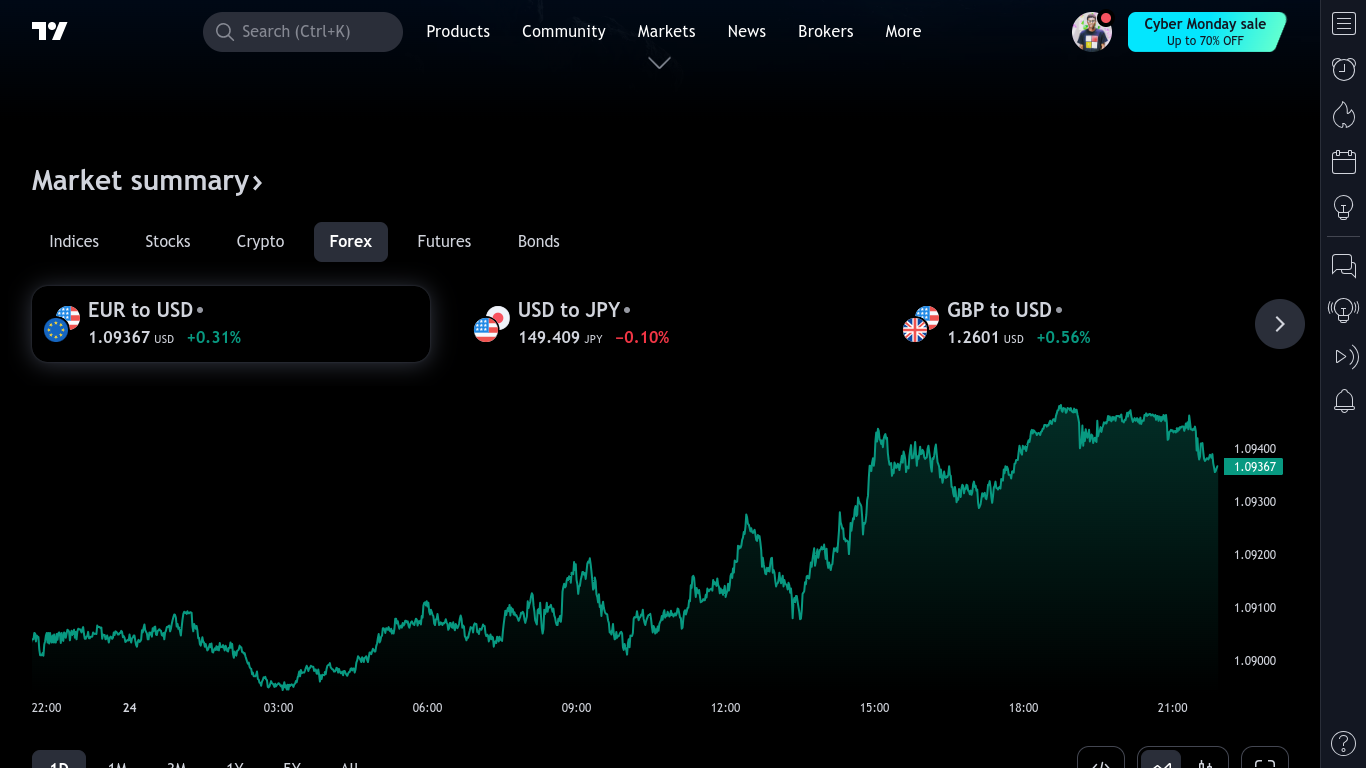

TradingView:

1. TradingView is a popular web-based platform that provides advanced charting tools and social networking for traders.

2. It offers a wide range of technical indicators, drawing tools, and customizable chart layouts.

3. Traders can analyze multiple asset classes, including forex, stocks, cryptocurrencies, and more.

4. The platform's interactive features allow traders to share ideas, analysis, and strategies with the trading community.

These tools and platforms play a crucial role in providing traders with the information, analysis, and resources they need to navigate the forex market effectively. Traders often

use a combination of these tools to conduct technical and fundamental analysis, monitor news and events, and engage with the trading community.