Do you believe in LUCK? Friends and family, achieving goals is very possible, though it doesn’t come without Diligence and Perseverance. Journey with me.

Growing up, I used to believe that wealth was purely a matter of LUCK. Some people seemed to be born with a silver spoon, while others appeared destined to struggle. Journeying from selling scraps, helping my mom sell charcoal, being a cleaner, waiter, and assisting a cook in the kitchen of a restaurant, and others I knew something had to change. As I embarked on my financial journey few years later, I came to understand that LUCK had very little to do with it.

The first significant step I took was setting a clear and concrete goal, which I still pursue today. I wrote it down and made it a tangible target. With this goal in mind, I knew I had to take control of my finances.

The journey was far from smooth. I encountered numerous setbacks and failures. There were moments I felt like throwing in the towel. Yet, through each failure, I learned valuable lessons. I refused to give up and continued to push forward, armed with new knowledge and a stronger resolve.

Reflecting on this journey, I can confidently say that it wasn’t luck that brought me here and it isn’t LUCK that is taking me where I am headed but a life lived “INTENTIONALLY.” It’s all about deliberate actions, smart work, dedication, and a strategic approach to managing and growing my finances.

Here are the KEY LESSONS I learned along the way:

Embrace Discomfort for Long-Term Comfort

One of my favorite personal quotes is, “You must be UNCOMFORTABLE to be COMFORTABLE.” This quote encapsulates the idea that achieving long-term comfort and success often requires enduring short-term discomfort and challenges. This means stepping out of your comfort zone, taking risks, and making sacrifices today to secure a better, more comfortable future. Whether it’s through hard work, disciplined savings and investing, continuous learning, or taking entrepreneurial risks, the temporary discomforts you face are necessary steps toward achieving your financial goals and overall well-being. In essence, embracing discomfort now paves the way for lasting comfort and security later.

Take Risks

Taking risks is an essential part of achieving financial success. Calculated risks, rather than reckless gambling, can open up opportunities for Growth. Whether it’s investing in financial markets like I do and always encourage others to do also, starting a business, or pursuing a new career path, risk-taking involves stepping out of your comfort zone. As a financial trader and private fund manager, I take calculated risks in the financial markets as part of my career. Most people want to be financially free but can’t take the risks needed to achieve that.

Set Clear Financial Goals

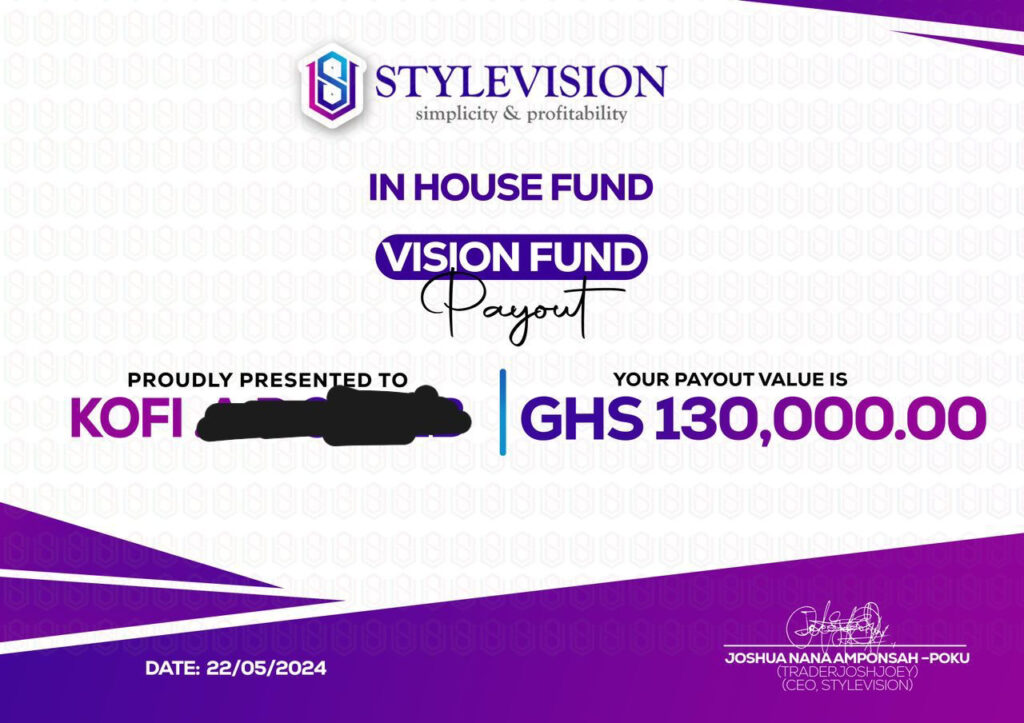

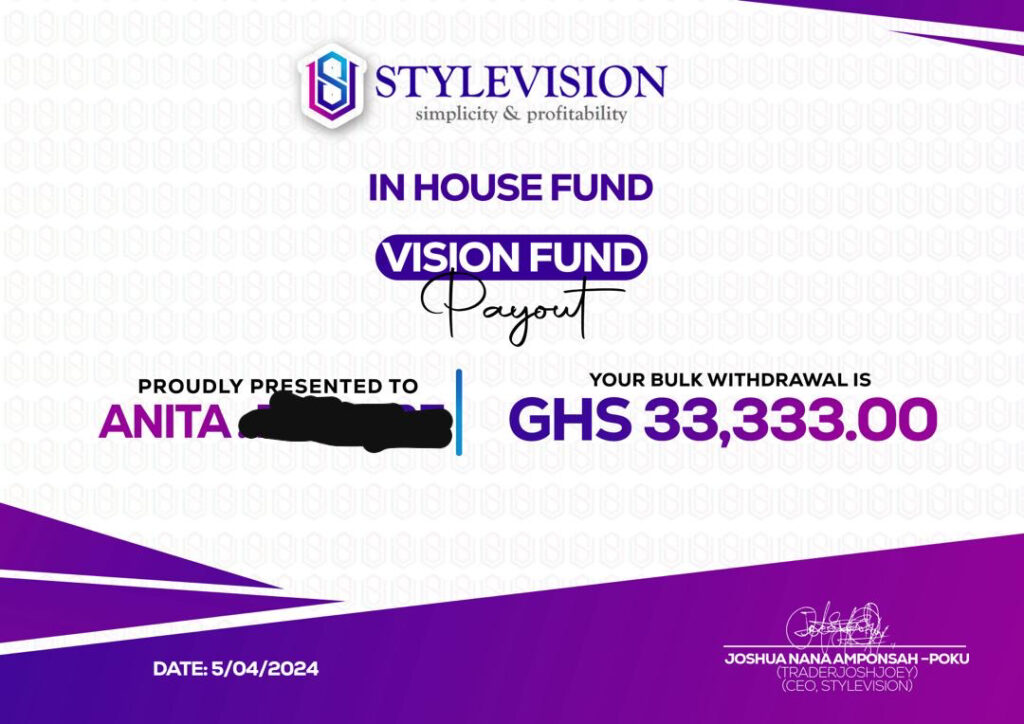

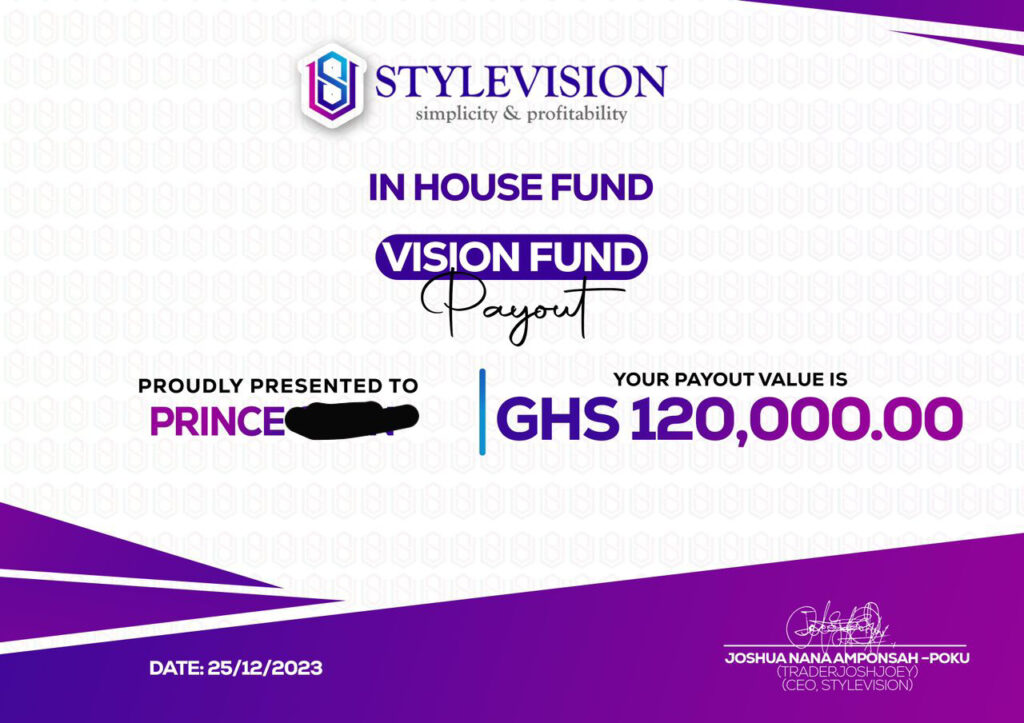

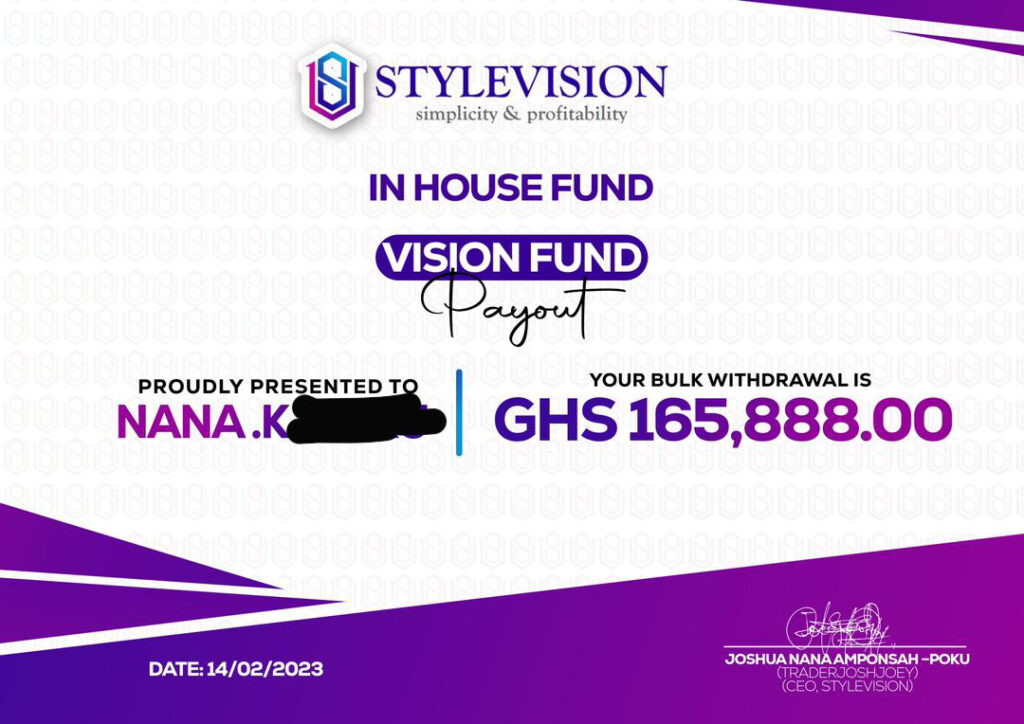

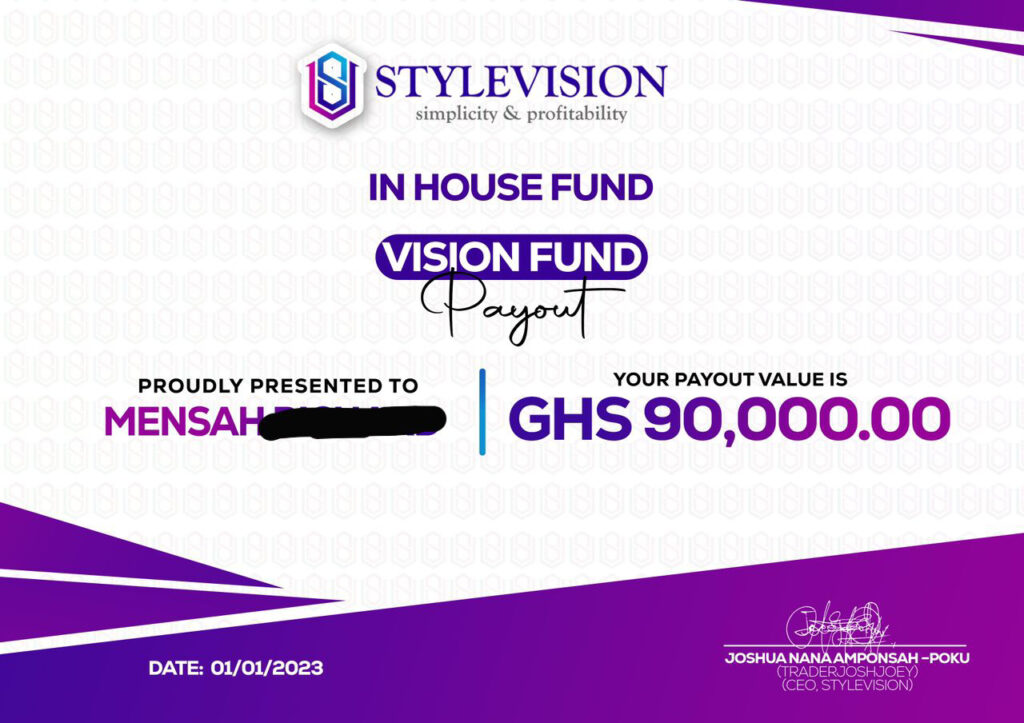

As a Financial trader and Private fund manager, having specific, measurable, achievable, relevant, and time-bound (SMART) financial goals provides direction and motivation. I set a goal to achieve GHS500,000 and more, which guided my actions and decisions. Clear goals help prioritise where to allocate resources and efforts. Breaking down large goals into smaller, manageable milestones helps track progress and stay motivated. Regularly reviewing and adjusting these goals ensures they remain aligned with changing circumstances and opportunities. For example did you know there others who make 50%, 100% to 140% and above profits investing funds in a Private fund…? Yes it’s been done but you would need know how by finding out and partaking of it. This is what has been done on a regular for some few years now with the participation of the Global financial markets trading. Examples of some payouts below;

It’s Safer to Work for Yourself than Someone Else

Entrepreneurship offers the potential for greater financial rewards and personal freedom. While it might seem safer to work for someone else, job security is not guaranteed in any position. Starting my own business allowed me to control my income, make strategic decisions, and create multiple streams of revenue. It’s important to prepare adequately before making this leap, such as building a robust business plan, understanding the market you are venturing into, and ensuring you have the necessary skills and resources. However, you need to START NOW, because you can never be fully prepared enough to run a business.

Live Below Your Means

Living below your means is a fundamental principle of financial stability and growth. This involves budgeting, mindful spending, and investing. By tracking my expenses and cutting unnecessary costs, I was able to save and invest more effectively. This discipline helps in accumulating wealth over time and provides a cushion for emergencies or investment opportunities. Making conscious choices that align with your long-term financial goals rather than succumbing to short-term gratifications is key.

Being a Private fund manager, I have had the opportunity to work with investors who apply this principle by having their funds managed rather they spending it on short-term gratification, as such some have been able to create another income cash flow source, some have bought lands, paid of some debts, organize weddings with funds generated from fund management that would have taken much longer period of time etc. Having a vision is crucial even investing profit target setting.

For instance, someone with GHS100,000 has the potential to grow that amount to double or even triple over time. If I have GHS100,000 and can afford to buy a car with it, but it’s the majority of my funds, purchasing the car would deprive me of the opportunity to earn substantial returns on that money. Instead, I would choose to invest that amount wisely in a trusted fund, aiming for a 50% or 100% return or more over some period of time. This way, I could potentially have GHS200,000, with a GHS100,000 profit while retaining my original GHS100,000. The same logic applies to any amount, whether it’s less or more.

Investing the GHS100,000 instead of spending it on a car allows for potential significant growth of your funds. By aiming for a 100% return, you can double your money, turning GHS100,000 into GHS200,000. This strategy leverages the power of investments to generate profit, providing greater financial security and growth potential, whereas spending it on a car would deplete your funds without offering the same opportunity for returns.

Caution: Ensure to avoid scam fund flipping services that end you up with losing all your funds. There are legitimate and trusted fund management services out there. Click here to learn about FUND MANAGEMENT.

Now it would be recommended to buy the car when you have already secured your financial goals through investments. By prioritising investment first and potentially growing your funds, you can later afford to buy the car without jeopardising your financial security. This approach ensures that you maintain or increase your wealth before indulging in non-essential purchases like a car, thereby balancing immediate desires with long-term financial growth. Hope this example helps.

Invest in Yourself and Your Future

Investing in yourself means committing to lifelong learning and personal development. This can include formal education, professional training, or self-study. For me, reading books on personal finance, attending seminars/webinars, and finance courses has been transformative. Knowledge enhances your ability to make informed decisions and adapt to changes. Additionally, skills and expertise can significantly increase your earning potential. Prioritising self-improvement builds a solid foundation for future success. At room i have my book corner where a great percentage of books there are financially related. I would encourage you start reading and consuming contents in finance. If you have managed to read this far this you have began the steps. Click here for more FINANCE related topics written by me; JOSH FINANCE.

Stay Disciplined and Patient

Building wealth is a long-term endeavor that requires consistency and patience. There will be setbacks and challenges along the way, but maintaining discipline is key. I developed habits such as regularly saving a portion of my income, continuously investing, and sticking to my budget. Patience is essential because significant financial growth doesn’t happen overnight. Compounded interest and investment returns accrue over time, so staying the course even during tough times is crucial. This same quality is taught to my fellow private investors and has enabled over the years to grow our funds as the lead trader and private fund manager.

Building a Strong Personal Brand

In today’s competitive landscape, building a strong personal brand is essential for financial and professional success. My personal brand is how I present myself to the world, encompassing my skills, experiences, and values. By cultivating a strong personal brand, I establish credibility, attract opportunities, and differentiate myself from others. This involves maintaining a professional online presence, networking, and consistently demonstrating my expertise and value in my field. A strong personal brand can leads to offers, partnerships, and increased earning potential, further supporting my financial goals.

Personal branding is a powerful tool for financial growth. It not only enhances your professional reputation but also opens doors to numerous opportunities that can significantly boost your financial success. By investing in and strategically managing your personal brand, you set the stage for sustained financial growth and stability.

Click here to see MY BRAND.

instagram here; @traderjoshjoey (Click here)

By embracing these principles and integrating them into your daily life, you can achieve financial success and security. The journey may be challenging, but with determination and strategic planning, it’s entirely attainable.

In conclusion, my journey till date has taught me invaluable lessons about achieving financial success. It’s not about luck, but about intentional actions, perseverance, and strategic planning. Setting clear goals, embracing discomfort for long-term gains, taking calculated risks, and investing in continuous self-improvement have been the pillars of my journey. Additionally, entrepreneurship, living below your means, and building a strong personal brand have played crucial roles in securing financial stability and growth. By applying these principles and staying disciplined, anyone can pave their way to financial independence and long-term security. Remember, Success is a journey that requires determination, resilience, and a proactive mindset. START TODAY, set your goals, and take deliberate steps towards realizing your financial dreams.

Click here for more FINANCE related topics written by me; JOSH FINANCE.

Visit : Traderjoshjoey.com

OTHER RELATED TOPICS.

MY FIRST $10,000 trading Forex; How I did it.

FROM $300 to $8,000 ; My Unbelievable RESULTS in ONE MONTH!

STARTING OUT; who is TRADERJOSHJOEY?

INVESTOR BOUGHT LAND WITH FUNDS FROM FOREX TRADING – Investor’s Land Grab

Art of Investing: Your Pathway to Financial Freedom. Make $1000s, $10,000s & more

MY FIRST $10,000 trading Forex; How I did it.

INVESTOR BOUGHT LAND WITH FUNDS FROM FOREX TRADING –

Investor’s Land Grab

Click to READ

Read how a Ghanaian Investor(Client) made GHS165,888.00 with only GHS5,000.00 (about $450) invested.

READ story; CLICK HERE

Disclaimer:

Thank you for reading our article. We want to make sure you understand a few important things:

- Informational Purpose: This article is for informational purposes only and is not personalized financial advice.

- Risk Awareness: Investing involves risks, and past performance is not a guarantee of future results. Be aware of the potential risks and uncertainties associated with financial decisions.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances.

- Educational Intent: Our aim is to provide educational content to help you make informed decisions. We encourage you to use this information as a tool for learning and understanding financial concepts.

- Your Decision: Ultimately, any decisions you make based on this information are your own responsibility.

Remember, knowledge is empowering. If you have questions or concerns, seeking advice from a financial professional is a smart step.

Thank you for your understanding.