Embarking on a Forex Journey: Growing $100(Ghc1,325) from SCRATCH

Click here to see MY BRAND.

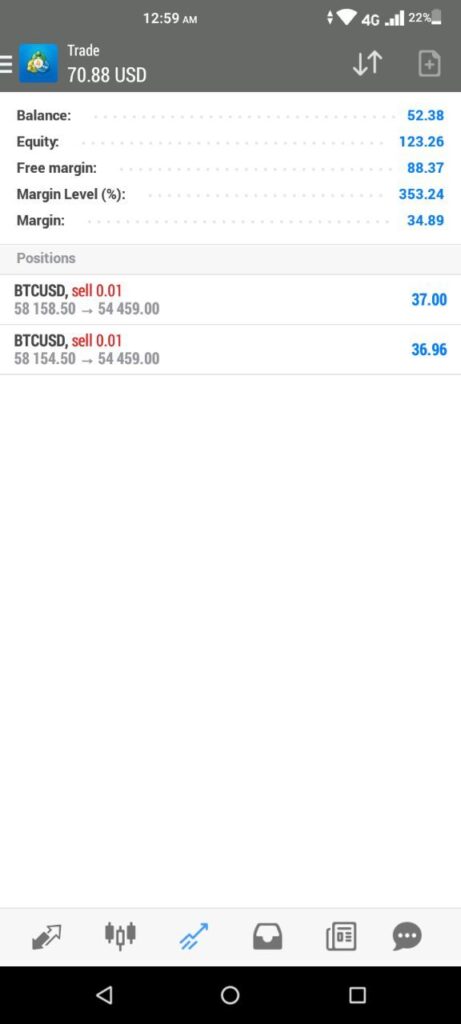

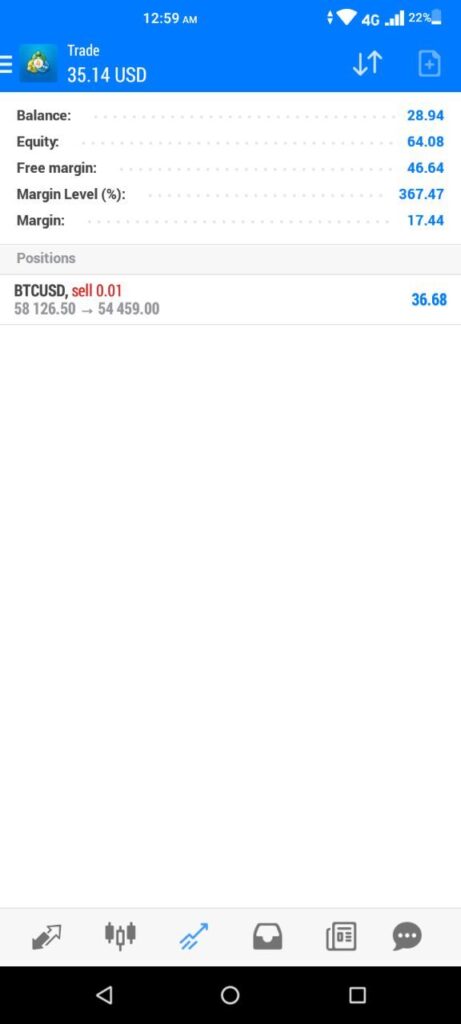

Embarking on a forex trading journey with just $100 may seem daunting, but with the right mindset, strategies, and discipline, it’s not only possible but also a valuable learning experience. In this blog post, I’ll share my detailed journey on how I would grow $100 trading forex if I were to start all over again. You might ask, what gives me the right and authority to teach on this. You are reading a blog post from someone who had made a habit of growing small accounts. Take a close look at each of the screenshots below;

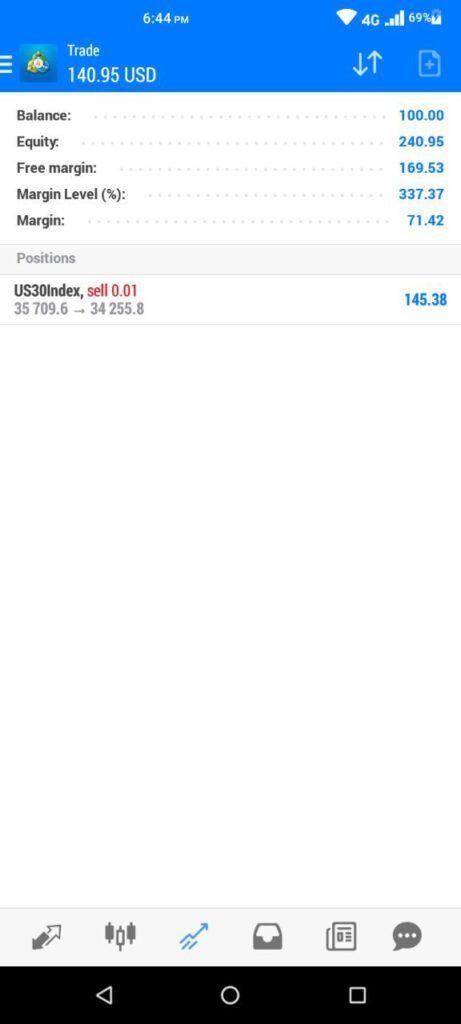

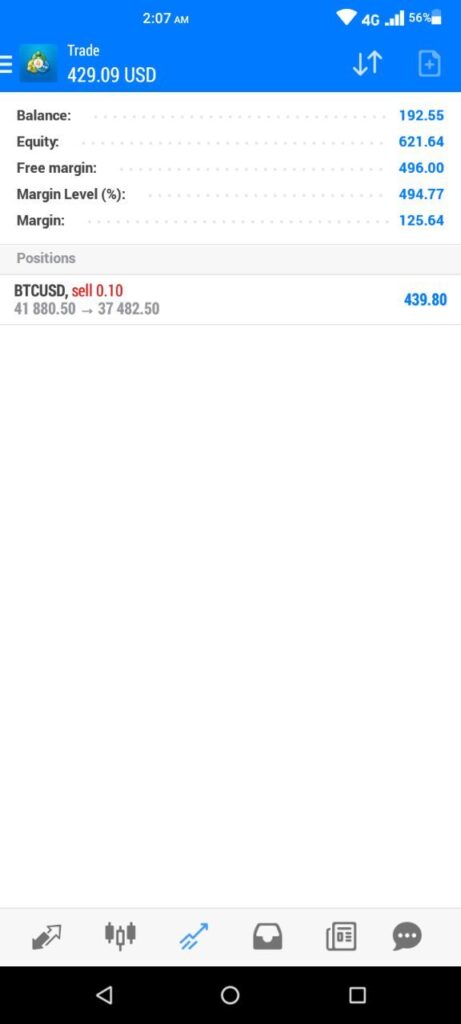

I have documented my Journey as a trader on most of my trades and experiences with the believe that someone like you would be reading this anytime in the future(which is now here).

One of the major steps in your journey as a trader is Funding and also the lack of funding being one of the hindrances from any success. I started out as a graphic designer, digital artist and with other side hustles that generated me some income here and there. I had some of the funds from my incomes source play a role in my forex account funding.

Even till date, there are days that I sometimes play around with small accounts like this and move them into profits and use such funds to take care of bills here and there or cover some purchases. From setting realistic targets to mastering risk management and identifying high-probability strategies, each step is a crucial building block towards sustainable growth in the forex market. Join me as I outline the path to turning a modest sum into a thriving trading account, navigating the highs and lows of the forex world with resilience and determination.

Even though it’s possible to grow a $100 account or small account sizes; many traders fund these account sizes and blow them up or lose them all and the reasons why are obvious. Let’s look at a journey on this; if I was to start over again with a $100.

1. Setting a Realistic Target:

Setting a realistic target is crucial for success in forex trading, especially when starting with a small capital like $100. Rather than aiming for unrealistic gains, I would set achievable goals, such as aiming for a consistent return of 2-5% and more. This not only keeps expectations in check but also allows for steady growth over time.

Practical Example:

At this time I have already made my mind that this $100 isn’t going to make me rich overnight rather it’s a journey. Instead of expecting to double or triple my account overnight, I would focus on making $5 to $10 consistently, gradually increasing as my trading skills improve.

2. Period of Trading:

Determining the period of trading is essential to align strategies and goals. I wouldn’t encourage anyone to jump into the market with a $100 or any amount above that just because you have enough to waste. However way you start affects your journey positively & negatively. For someone starting with $100, I would commit to a long-term approach(which is relative to the type of trader you are), aiming for sustainable growth over days, weeks and even months for some rather than seeking quick profits.

Practical Example:

For a beginner SCALPER growing a samll accounts with require you to take multiple trades during the day and weeks, you are encouraged to ensure to a realistic targets per day and during the week. I have had the opportunity to take scalp trades and I still do. With a small account, it will depend on your strategy which would require you take multiple trades or entries of different times. In some, it’s the lot size position to hit good profits in short term. But also looking the other side of scalping which encourages more losses as without adequate training and experience in scalping you could lose the $100 or any small account being traded. Below is a scalping that was done with multiple trades in the 1 – minute timeframe on the GBPUSD currency, selling and re-selling based on my scalp strategy.

For a beginner DAY TRADER, growing a small accounts such as a $100 fund would require you to take at least 1 to 3 trade per week which all depends on your strategy being profitable and if you are beginner I would figure your strategy might not be so profitable yet. The image below shows a trade that was taken on NZDUSD pair that I left to run for close to 8hrs as a day trade.

So for example trades can run for hours in profits with probably a balance of initial $100 or more and equity running $210 which means if profits is closed at this value- you balance after is $210 which is a now the account size value. So one step(trade) at a time.

For a beginner SWING TRADER, you will be required to take trades that can last a bit more than a day, which means you can have some good trades if only the strategies being utilized are good and have high probability winning rate over losses. If they aren’t, being in a trade for days won’t make any difference if it finally in loses. A screenshot below shows a trade on a 30mins timeframe that had run for more than a day and kept running as Swing trade.

But regardless losing is part of the industry and in all trading styles listed above. Risk to Reward trading.

NOTE:

Practically;

For example in trading, the 3 types of traders(scalpers, day & swing traders) can take $100 to $1000 profits but how and how long it would take each trader would achieve this would differ from trader to trader.

Each trader in this case would have their own strategy, their own timeline they believe they can use to accomplish this task.

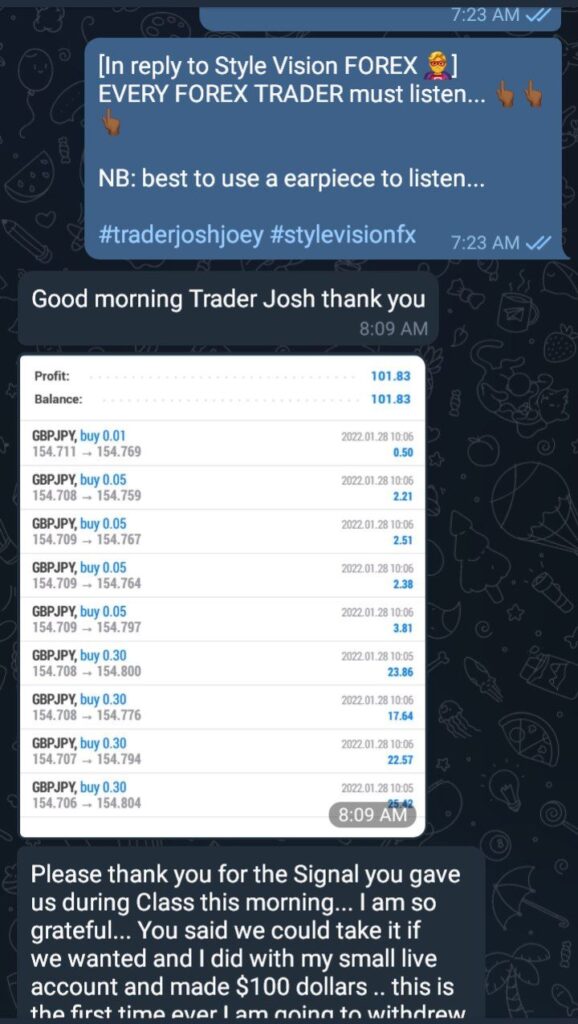

During one of our live trading sessions I gave a day trade setup / signal which helped quite a couple of traders who made profits trading with me, with for example Joy being an example who made her first $100 trading profits and her first time ever to withdraw as she state in the screenshots below.

3. Risk Management Plan:

Losing the $100 already? You might though. For a complete beginner who’s still getting your hands on experience, you are likely to lose your first $100 fully or reduced but that’s not the focus. I am not any fashion encouraging that you blow your $100 account or blow any accounts at all, it’s quite the opposite. The focus is that you work with what am sharing and see a progress in your trading. Effective risk management is paramount to protect capital and ensure longevity in forex trading. With a limited starting capital, I would prioritize preserving my $100 while still having the potential for growth.

The right application of lot sizes is also very important as you do not want to over do it. Many traders who start from the demo environment don’t get to build a plan for their practice period so they turn to use any lot size but when they run into the live trading environment, it’s a totally new experience.

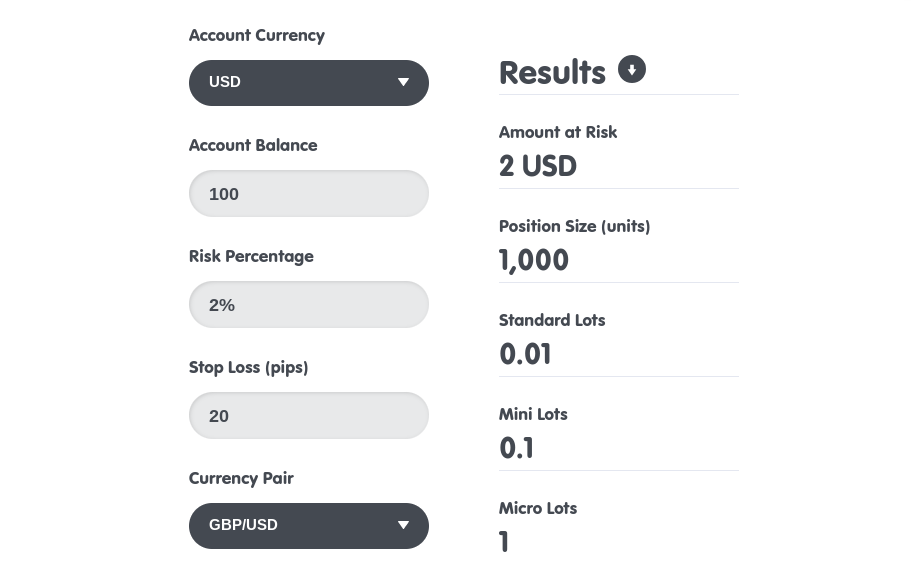

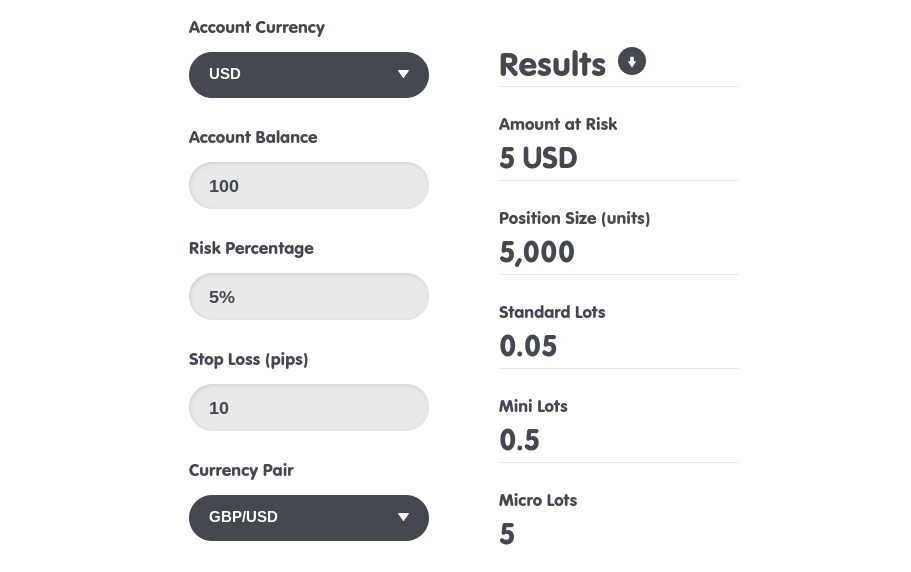

Thanks to Baby Pips Calculator I am able to get good lot sizes ideas for any account size that I trade. So having a $100 you can know based on your style of trading, your risk tolerance etc. Here you will place your account balance, risk percent per trade or entry, the stop loss on the trade setup and also the currency pair you will be trading. Get the FOREX CALCULATOR for FREE – CLICK HERE

Practical Example;

For example, the above screenshots are examples of $100 inputs details and you can see the difference in approach below;

For instance if you were to take trades with a $100, if the probability is high on your side in terms of strategy and now applying a risk management approach the Wins could be very potential.

For example; you take a 10 Total number of trades and manage to hit 7 and above trades, the Risk to Reward (R:R) – 1:3 means

You are willing to lose 1 to 3 per trade,

In other wards, for example $5:$15

So high number of trades are profitable; you will be on the WIN.

4. 1 to 3 High Probability Strategies:

This part is very good for every trader from all levels especially my target reader for this updated post; Beginner traders. Rather than spreading myself thin with multiple strategies, I would focus on mastering 1 to 3 high-probability strategies that suit my trading style and personality. These strategies should have a proven track record of success and be adaptable to different market conditions. And you will get this figured out after trying a few or more demo practicing and bactesting. Now try out some strategies and you will get this sorted out with a bit of patience.

Practical Example:

I might focus on simple yet effective strategies like trend following, support and resistance trading, and price action analysis, mastering each one before moving on to the next. So you go straight into. I have grown several small account sizes with proven strategies here and there and these could be scalp, day or swing trades.

5. Journaling:

Keeping a trading journal allows traders to track their progress over time. By recording each trade, including entry and exit points, position size, and reasoning behind the trade, traders can analyze their performance objectively. Reviewing past trades helps identify strengths and weaknesses, allowing for continuous improvement. Keeping a detailed trading journal is indispensable for continuous improvement and learning from both successes and failures. I would meticulously record every trade, including entry and exit points, reasons for the trade, and emotions involved. Today, I am able to show you my trades screenshots dated back in time for you to clearly see how I take my archive very serious.

Practical Example:

I would use a spreadsheet or dedicated trading journal software to log all my trades, regularly reviewing past trades to identify patterns and areas for improvement.

6. Staying Discipline::

Remember, trying to grow small funds isn’t an easy as some would make it look because they have skilled up and with years of trading flip small accounts. Discipline is the cornerstone of successful trading, especially when faced with the temptations of greed and fear. I would adhere strictly to my trading plan, avoiding impulsive decisions and sticking to my predetermined risk management rules. Remember, trying to grow small funds isn’t an easy as some would make it look because they have skilled up and with years of trading flip small accounts.

Practical Example:

I would resist the urge to deviate from my plan, even in the face of consecutive losses or unexpected market movements, trusting in my strategy and staying patient for long-term success.

Start learning how to trade for FREE on our ACADEMY Lessons available here – CLICK HERE

Click here to see MY BRAND. instagram here; @traderjoshjoey (Click here)

Do follow me on instagram here; @traderjoshjoey (Click here)

Visit : Traderjoshjoey.com

Who is Traderjoshjoey ? and how did I start… click to READ.

Read how a Ghanaian trader made $8,000 (GHS 99,200) from a $300 (GHS 3,720) deposit.

Read story; Click here

For more SUCCESS STORIES, scroll below

INVESTOR BOUGHT LAND WITH FUNDS FROM FOREX TRADING –

Investor’s Land Grab

Click to READ

Read how a Ghanaian Investor(Client) made GHS165,888.00 with only GHS5,000.00 (about $450) invested.

READ story; CLICK HERE

Disclaimer:

Thank you for reading our article. We want to make sure you understand a few important things:

- Informational Purpose: This article is for informational purposes only and is not personalized financial advice.

- Risk Awareness: Investing involves risks, and past performance is not a guarantee of future results. Be aware of the potential risks and uncertainties associated with financial decisions.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances.

- Educational Intent: Our aim is to provide educational content to help you make informed decisions. We encourage you to use this information as a tool for learning and understanding financial concepts.

- Your Decision: Ultimately, any decisions you make based on this information are your own responsibility.

Remember, knowledge is empowering. If you have questions or concerns, seeking advice from a financial professional is a smart step.

Thank you for your understanding.