Today, I want to share with you an exhilarating journey I embarked on. It was a regular Wednesday, just like any other trading day. Little did I know, it would turn out to be one of the most memorable days in my trading career. Let me take you through the play-by-play of how I turned a humble $1,500 into an impressive $5,663(Ghs72,580.41) in less than 12hrs from trading the financial markets.

One of the many important guides I received when I started trading was – Journaling. I was encouraged to journal my journey and my trades which was essential for self-reflection, learning from past decisions, accountability, and building credibility. It provides a transparent record of my experiences, helps me improve my trading strategies, and inspires others in the trading community. It also helps me to learn from my mistakes, and also to help improve on my successful turnouts. So this is why I have pictures, screenshots etc from when I started and till date I keep record of my progress.

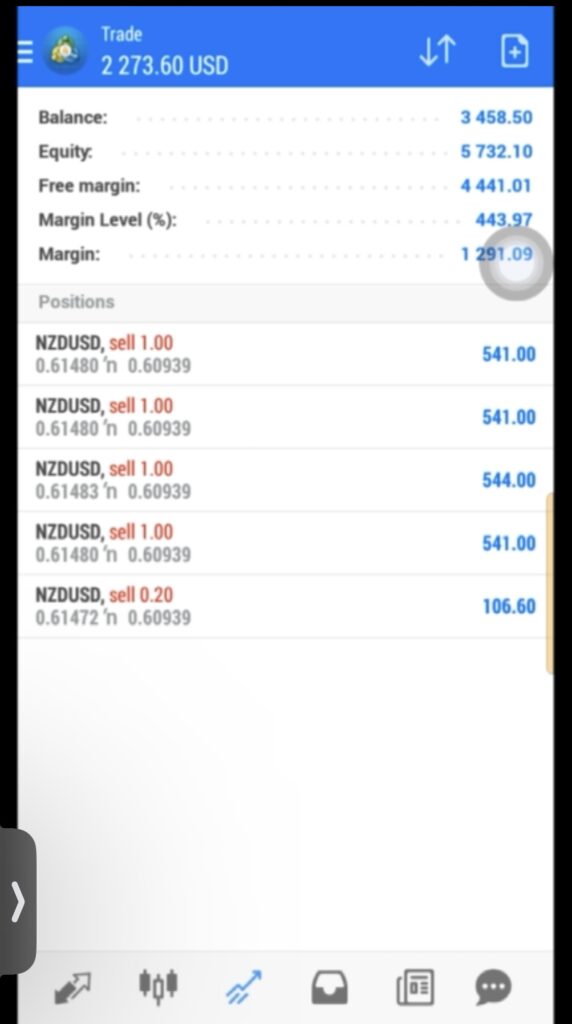

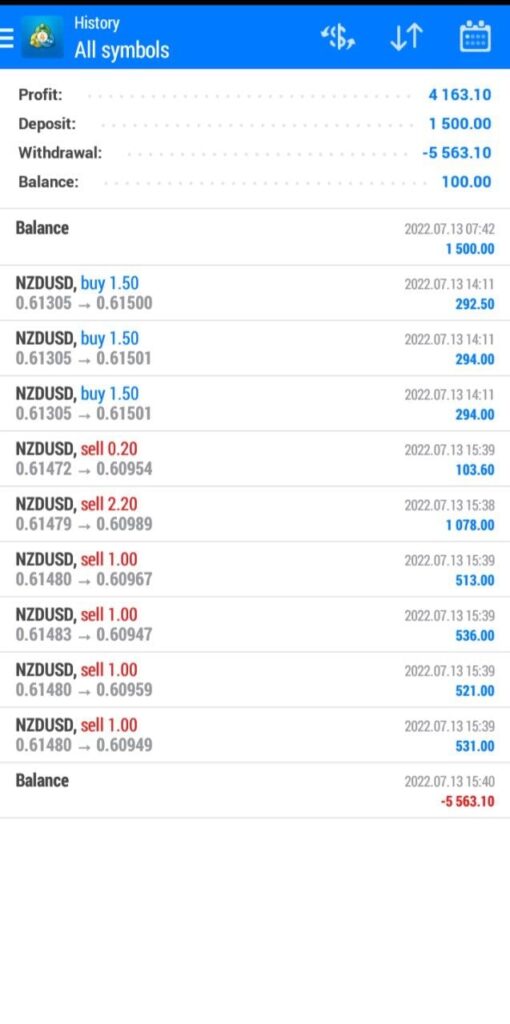

As usual on one Wednesday, I started my day by analyzing the forex markets, particularly focusing on the NZDUSD pair. After making a decent profit of around $900, I was ready to call it a day. But something caught my eye—an opportunity that seemed too good to pass up. I spotted a setup that aligned perfectly with my trading strategy, so I marked my levels and prepared to dive back into the markets.

However, before taking any further action, I decided to check the economic calendar on Forex Factory for any upcoming fundamental events. And there it was, gleaming on the horizon—a CPI News release scheduled for 12:30 GMT.

With my account balance sitting at $2,376 ($1,500 initial deposit + $876 profit), I faced a pivotal decision. I could either play it safe and stick to my usual risk management plan and just maintain what i have already made, or I could take a bold leap and capitalize on the potential opportunity presented by the CPI news release. After careful consideration, I opted for the latter, fully aware of the high risks involved. Though a Day trader, this trade was obviously a Scalp trade. With most of my News trading, it’s usually a scalp trade. NFP, CPI, PPI, FOMC news release are mostly my go to when it comes to scalping.

As the clock ticked closer to 12:30pm, I anticipated a sell-off on the NZDUSD pair. And lo and behold, my prediction proved to be spot on.

The trade unfolded exactly as I had forecasted, and within moments, I found myself staring at a total account balance of $5,663.

Now, let me pause here for a moment and emphasize the significance of what just transpired. This wasn’t just a lucky break or a random gamble. It was the result of meticulous analysis, calculated risk-taking, and unwavering conviction in my trading strategy.

The above is the trade before and after trade. However, I must stress that this type of high-risk trading is not for the faint of heart. I wouldn’t recommend it to beginners or even seasoned traders unless they are fully prepared to accept the possibility of significant losses. In my case, I had mentally prepared myself for the worst-case scenario and was willing to accept the outcome, whatever it may be.

The same result could be achieved by any type of trader whether scalper, day trader or a swing trader. A day trader could have taken multiple trades within a week or month or months to achieve that. A swing trader could have also achieved the same results by letting his/her trade run for hours to days and even some to months. As a day trader; my option based on my trading strategy was to scalp this opportunity. So what is important here is to identify the potentials, calculate your risk and go for it.

(I teach my trainees the techniques and the strategies that make these testaments possible, to enroll click here – CLASS with Traderjoshjoey and Sign up.)

After securing my profits, I wasted no time in withdrawing $5,563 from my account, leaving behind a modest $100 as a testament to the remarkable journey I had just undertaken.

In conclusion, this experience taught me valuable lessons about risk management, market analysis, and the importance of staying true to your trading convictions. While the allure of quick gains may be tempting, it’s essential to approach trading with caution and discipline.

I hope you found this story both entertaining and educational. Remember, trading is not just about making money—it’s about continuous learning and growth. Until next time, happy trading!

One of the favorites feeling of writing these blog posts is that – am able to take you guys on a journey back then, current time and looking forward to what is in-store for me in the future.

Yours in trading success,

Traderjoshjoey.

Quick One;

Remember, the mind is a powerful tool, and with the right affirmations, you have the ability to shape your reality and create the life of your dreams. Amidst the charts, indicators, and economic data, there’s one element that often goes unnoticed but plays a crucial role in my trading success: AFFIRMATIONS.

Affirmations are more than just positive statements; they are powerful tools that shape our mindset, beliefs, and ultimately, our reality. As a trader, I’ve witnessed firsthand the transformative effects of incorporating affirmations into my daily routine.

(I teach my trainees the techniques and the strategies that make these testaments possible, to enroll click here – CLASS with Traderjoshjoey and Sign up.)

I encourage you to embrace the power of affirmations. Start each day with intention, speak your desires into existence, and watch as the universe conspires to bring your dreams to fruition.

Start learning trading for FREE– click here

My First $10,000 Trading the Forex Markets – Click here to Read

Do follow me on instagram here; @traderjoshjoey (Click here)

For more SUCCESS STORIES, scroll below

Read how a Ghanaian Investor(Client) made GHS165,888.00 with only GHS5,000.00 (about $450) invested.

READ story; CLICK HERE

Join our Direct 2-3months training program with Traderjoshjoey CLICK HERE TO JOIN to Speak to us.

Disclaimer:

Thank you for reading our article. We want to make sure you understand a few important things:

- Informational Purpose: This article is for informational purposes only and is not personalized financial advice.

- Risk Awareness: Investing involves risks, and past performance is not a guarantee of future results. Be aware of the potential risks and uncertainties associated with financial decisions.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances.

- Educational Intent: Our aim is to provide educational content to help you make informed decisions. We encourage you to use this information as a tool for learning and understanding financial concepts.

- Your Decision: Ultimately, any decisions you make based on this information are your own responsibility.

Remember, knowledge is empowering. If you have questions or concerns, seeking advice from a financial professional is a smart step.

Thank you for your understanding.