INTRODUCTION

There was a client who wanted to wed his beloved partner. For privacy, lets use the name Alex in reference to him. Like many, he faced the daunting task of financing his wedding while juggling financial constraints. Traditional routes seemed unattainable, and the prospect of taking out a loan left him wary of potential pitfalls. Also having knowledge of past stories were people ended up in trouble because they had gone for a loan; either personal or business loan and spending those funds on a wedding and met Pitfalls. Client Alex was torn between deciding to take a loan or work to get that amount; valued at the range of GHS85,000.00 to GHS90,000.00; the budget for the entire wedding; consisting of purchase of rings, attires, venue cost, decor, food provision, media(photography & videography), transportation etc. But getting that results seem a bit far fetch(unrealistic/difficult to attain).

However, with the guidance of a seasoned financial trader and fund manager, Alex discovered an alternative path to achieving his goal without compromising his financial stability.

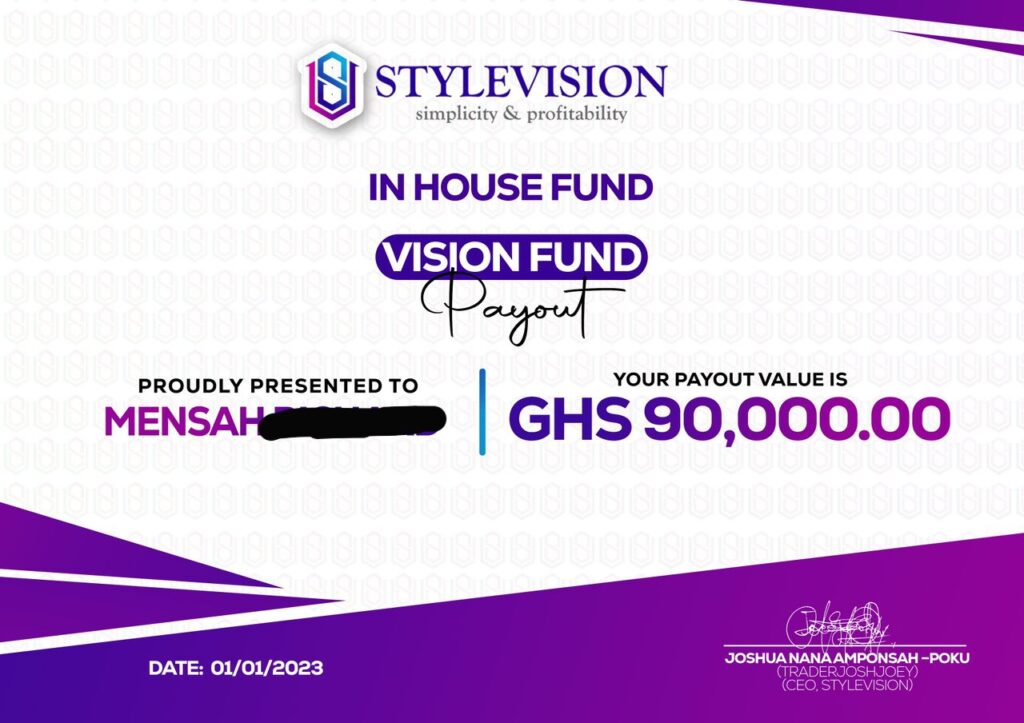

Investing in the financial markets, such as the forex market, became Alex’s ticket to turning his seed capital into a substantial sum for his wedding fund and in his case a Total Withdrawal of GHS90,000.00 handsfree.

But what exactly is investing, and how does it relate to the forex market?

Investing is the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. In the context of the financial markets, investing involves allocating funds into assets such as stocks, bonds, or currencies, with the aim of generating returns over time. The forex market, specifically, deals with the buying and selling of currencies, providing opportunities for investors to profit from fluctuations in exchange rates.

A forex fund manager – a professional skilled in navigating the complexities of the forex market to maximize returns for their clients. In Alex’s case, the fund manager played a pivotal role in leveraging his initial capital to generate a profit of great percentage%, resulting in a total withdrawal of GHS90,000.00.

This successful collaboration between an investor and trader exemplifies the relationship built on trust, expertise, and shared goals.

- Investor:

Role: An investor(Alex) is someone who provides capital (money) to a Forex fund.

Objective: Investors aim for short and long-term growth and capital appreciation.

Approach: Typically, investors are more patient and less focused on short-term market fluctuations.

Involvement: They delegate the active trading decisions to a fund manager or a team of traders. The investor(Alex) therefore has chosen a handsfree approach to making money; allow their money make money. In other terms; relaxing while someone manages you fund. If you are looking to have multiple stream of income; then this is the option investors choose.

- Trader (Managing for Investors):

Role: A trader is the person or team responsible for making active buy and sell decisions within the Forex market on behalf of investors.

Objective: Traders aim to maximize short to medium-term profits by taking advantage of market movements.

Approach: They analyze market trends, news, and technical indicators to make informed trading decisions.

Involvement: Traders actively execute trades, manage risk, and strive to achieve the best possible returns within the investor’s risk tolerance.

The above scenario shows the important of targets; Defining targets helps align your investments with specific financial goals, such as retirement, education, or purchasing a home. This ensures that your investment strategy is tailored to meet your unique objectives.

But why is purposeful investing crucial, especially in scenarios like Alex’s? Purposeful investing involves aligning financial goals with investment strategies, ensuring that each investment serves a specific purpose or objective. In Alex’s case, the goal was clear – to fund his wedding without resorting to burdensome loans or sacrificing financial stability. By investing purposefully, Alex not only achieved his goal but also laid the foundation for future financial endeavors.

Now, let’s delve into why taking a personal loan / borrowing money for a wedding might not be the wisest decision:

DO NOT TAKE A LOAN TO HAVE A WEDDING

- Debt burden: Taking out a loan adds to one’s debt burden, potentially straining finances for years to come.

- Interest payments: Loans often come with high-interest rates, resulting in substantial long-term costs.

- Financial stress: The pressure of repaying a loan can lead to significant stress and anxiety, impacting overall well-being.

- Limited flexibility: Loan repayments restrict financial flexibility, limiting opportunities for future investments or expenses.

- Risk of default: Inability to repay the loan could lead to dire consequences, including damaged credit scores and legal action.

SUCCESSFUL TURNOUT

Through careful planning and wise investing with the help of a forex fund manager, Alex successfully hosted the wedding he had dreamed of. Despite financial challenges, his commitment to purposeful investing paid off, generating enough funds within the planned timeframe. Surrounded by loved ones on their special day, Alex and his partner celebrated their love, showcasing the positive impact of determination and strategic financial decisions. Their wedding not only marked a new chapter but also highlighted the importance of setting clear goals and pursuing them with perseverance.

In conclusion, Alex’s journey exemplifies the power of purposeful investing in achieving financial goals. By partnering with a forex fund manager and embracing a strategic approach to investing, he was able to turn his wedding dreams into reality without compromising his financial future. Remember, whether planning a wedding or pursuing other financial aspirations, investing with purpose can pave the way to a brighter financial future.

below is the PAYOUT CERTIFICATE of investor MENSAH.

Interested in Fund management ? Learn more about how we can tailor a strategy to align with your financial goals. Click below to schedule a consultation and start your journey with us.

CLICK HERE

Click here to access MY BRAND. Instagram here; @traderjoshjoey (Click here)

For more SUCCESS STORIES, scroll below

INVESTOR BOUGHT LAND WITH FUNDS FROM FOREX TRADING –

Investor’s Land Grab

Click to READ

Read how a Ghanaian Investor(Client) made GHS165,888.00 with only GHS5,000.00 (about $450) invested.

READ story; CLICK HERE

follow me here on Instagram @traderjoshjoey (Click here)

Traderjoshjoey on Instagram

Traderjoshjoey on Facebook

Disclaimer:

Thank you for reading our article. We want to make sure you understand a few important things:

- Informational Purpose: This article is for informational purposes only and is not personalized financial advice.

- Risk Awareness: Investing involves risks, and past performance is not a guarantee of future results. Be aware of the potential risks and uncertainties associated with financial decisions.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances.

- Educational Intent: Our aim is to provide educational content to help you make informed decisions. We encourage you to use this information as a tool for learning and understanding financial concepts.

- Your Decision: Ultimately, any decisions you make based on this information are your own responsibility.

Remember, knowledge is empowering. If you have questions or concerns, seeking advice from a financial professional is a smart step.

Thank you for your understanding.