In the world of finance, managing millions in your 20s is a rare feat achieved by a select group of individuals with exceptional talent and foresight. This article delves into the fascinating stories of legendary fund managers who, during their 20s, not only navigated the complexities of the financial markets but also successfully managed other people’s money, laying the groundwork for their future billionaire status.

Warren Buffett: The Oracle of Omaha

Warren Buffett, often referred to as the Oracle of Omaha, started his journey as a fund manager in his 20s. Armed with a passion for investing and guided by the principles of his mentor Benjamin Graham, Buffett founded the Buffett Partnership Ltd. in 1956.

With an initial capital of around $105,000, Buffett’s astute investment strategies and patient approach led to remarkable success, ultimately transforming Berkshire Hathaway into a global conglomerate. He had access to a pool funds from investors to invest in various businesses and stocks. He worked closely with Charlie Munger, who would become his long-time business partner.

Buffett is also known for his commitment to philanthropy. In 2006, he pledged to donate the majority of his wealth to charitable causes, particularly through the Bill & Melinda Gates Foundation.

Warren Buffett’s journey from a young investor to a billionaire provides valuable lessons for anyone interested in finance and investing. His emphasis on fundamentals, patience, and a long-term perspective has made him an iconic figure in the world of finance.

Lesson Learned: Buffett’s emphasis on value investing and long-term perspectives teaches us the power of patience and the importance of fundamental analysis in wealth creation.

According to FORBES, his networth currently is valued below: related article

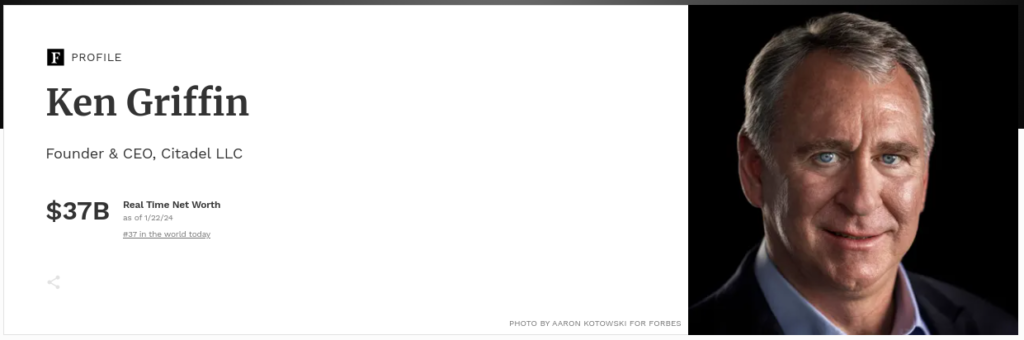

Ken Griffin: Citadel’s Entrepreneurial Founder

Ken Griffin, the founder of Citadel, entered the finance world in his 20s with a passion for trading. In 1990, Griffin founded Citadel, leveraging quantitative strategies to navigate the complexities of the financial markets. His innovative approaches and ability to manage risk contributed to Citadel’s exponential growth, solidifying his status as a prominent hedge fund manager.

In 1990, at the age of 22, Griffin founded Citadel with the goal of applying quantitative strategies to trading. Citadel initially focused on convertible bonds before expanding into other asset classes. Griffin and Citadel gained recognition for their quantitative approach to investing, utilizing mathematical models and computer algorithms to make trading decisions. Citadel experienced substantial growth under Griffin’s leadership. The firm expanded into various strategies, including equities, fixed income, and commodities, becoming one of the largest and most successful hedge funds globally.

Information about the specific amount of money Griffin raised in his 20s may not be readily available. Still, Citadel’s growth and success indicate his adeptness at managing substantial sums for investors early in his career.

Griffin has become a prominent figure in the finance industry and a notable philanthropist. His philanthropic efforts include significant donations to various causes and institutions.

Lesson Learned: Griffin’s success underscores the importance of innovation and risk management in building and sustaining a successful hedge fund.

According to FORBES, his networth currently is valued below: related article

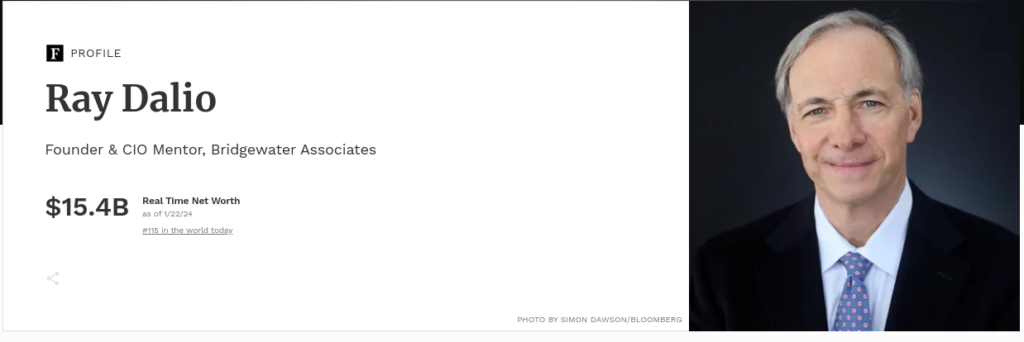

Ray Dalio: Bridgewater’s Visionary Leader

Ray Dalio, the founder of Bridgewater Associates, started managing other people’s money in his 20s. Launching his investment partnership in 1975, Dalio applied principles of global macro investing and risk parity strategies, leading Bridgewater to become one of the world’s largest hedge funds. His early success was marked by an ability to adapt to changing market conditions and a commitment to understanding economic cycles.

In 1975, shortly after completing his education, Dalio founded Bridgewater Associates out of his apartment. It began as a small investment advisory service.

Dalio developed a unique investment philosophy that focused on economic cycles and global macroeconomic trends. This approach became a cornerstone of Bridgewater’s success.

In 1975, Dalio launched Bridgewater’s first hedge fund, which was called the “Bridgewater Pure Alpha” fund. It aimed to profit from global economic trends and market inefficiencies and Over the years, Dalio pioneered the risk parity strategy at Bridgewater, which involves balancing investments across different asset classes to optimize risk and return.

As for the specific amount of money Dalio raised in his 20s, the information might not be readily available. However, Bridgewater Associates’ success and growth are indicative of his skill in managing other people’s money early in his career. The hedge fund’s innovative strategies contributed to its prominence in the finance industry.

Lesson Learned: Dalio’s story emphasizes the significance of staying adaptable and employing diversified strategies to thrive in diverse market environments.

According to FORBES, his networth currently is valued below: related article

Paul Tudor Jones: Mastering Global Macro Trading

Paul Tudor Jones launched Tudor Investment Corporation in 1980, applying a global macro trading approach. His early successes included predicting the Enron scandal, showcasing his ability to identify market inefficiencies. Jones’s flexibility and adaptation to various economic environments played a crucial role in Tudor Investment Corporation’s growth.

Born on September 28, 1954, is an American billionaire hedge fund manager and philanthropist. In 1980, at the age of 26, Tudor Jones founded Tudor Investment Corporation. He started with a focus on the futures market, particularly currency and interest rate futures.

Tudor Jones gained early success by applying quantitative strategies to his trading. His ability to predict market trends, especially during volatile periods, contributed to the growth of Tudor Investment Corporation and known for his emphasis on risk management. He developed the “Tudor Risk Parity” strategy, which aims to balance risk across different asset classes.Tudor Jones became renowned for his global macro trading approach, where he analyzes and invests based on macroeconomic trends and geopolitical events and Over the years, Tudor Jones adapted his investment style to changing market conditions, showcasing flexibility in navigating various economic environments.

udor Investment Corporation grew significantly under his leadership. While specific details about the funds raised in his 20s may not be publicly disclosed, the firm’s success indicates Tudor Jones’s ability to attract and manage substantial capital. In addition to his success in finance, Tudor Jones is involved in philanthropy, particularly through the Robin Hood Foundation, which focuses on poverty alleviation in New York City.

Lesson Learned: Jones’s story emphasizes the importance of staying informed about global economic trends and adapting strategies to changing market conditions.

According to FORBES, his networth currently is valued below: related article

Seth Klarman: Baupost’s Conservative Genius

Seth Klarman, founder of Baupost Group, demonstrated his financial acumen by founding his investment partnership in the early 1980s. Klarman’s conservative and value-oriented investment philosophy, coupled with a focus on distressed assets, contributed to Baupost’s success. His early emphasis on risk management and fundamental analysis set the foundation for the firm’s growth.

In 1982, Klarman founded Baupost Group with a focus on value investing and distressed assets. The firm initially managed a relatively small amount of capital. Klarman is known for his conservative and value-oriented investment approach. He seeks undervalued or distressed assets, often taking a long-term perspective.

Baupost gained a reputation for its risk-averse strategies and ability to navigate challenging market conditions. Klarman’s emphasis on preserving capital and avoiding permanent losses contributed to the firm’s success. Baupost’s success led to a steady growth in assets under management (AUM). While specific details about the funds raised in Klarman’s 20s might not be publicly disclosed, the firm’s increasing AUM indicates his skill in attracting and managing capital from investors.

Klarman maintains a relatively low public profile, and his investment letters and writings, particularly his book “Margin of Safety,” are highly regarded in value investing circles.

Lesson Learned: Klarman’s story teaches us the value of patience, conservative strategies, and the potential rewards of investing in distressed assets.

According to FORBES, his networth currently is valued below: related article

Jim Chanos: The Short-Selling Expert

Jim Chanos, founder of Kynikos Associates, entered the financial world with a focus on short selling. Chanos gained early recognition for his skill in identifying overvalued stocks, particularly through his successful short position on Allied Capital. His early success in short selling solidified his reputation as an expert in identifying market inefficiencies.

In 1985, Chanos founded Kynikos Associates, a hedge fund that specializes in short selling. The firm’s name is derived from the Greek word “kynikos,” meaning cynic. Chanos gained early recognition for his skill in identifying overvalued stocks and implementing short-selling strategies. Short selling involves betting that the price of a security will decline. One of Chanos’s most notable successes was his early recognition of issues at Enron. He actively shorted Enron’s stock before the company’s accounting fraud and financial troubles became widely known.

Chanos’s investment approach revolves around fundamental analysis, scrutinizing financial statements and company fundamentals to identify potential weaknesses.Kynikos Associates expanded its short-selling activities to cover various sectors, including technology, finance, and healthcare, showcasing Chanos’s ability to adapt to changing market conditions.

While specific details about the funds raised in Chanos’s 20s may not be publicly disclosed, Kynikos Associates has grown to become a respected hedge fund, managing assets for institutional and individual investors.

Chanos is involved in educational initiatives, lecturing on short selling and financial markets at universities. He also served as the president of the New York-based Coalition of Private Investment Companies.

Lesson Learned: Chanos’s story teaches us the importance of a contrarian mindset, diligent research, and the potential opportunities in short selling.

According to CelebrityNetworth, his networth currently is valued below: related article

David Einhorn: Greenlighting Success

David Einhorn, founder of Greenlight Capital, started managing other people’s money in 1996. Einhorn’s value investing approach, activism, and early success in short selling Allied Capital contributed to Greenlight Capital’s growth. His ability to navigate diverse sectors and adapt to changing market conditions showcases his investment prowess.

Born on November 20, 1968, is an American hedge fund manager, investor, and philanthropist. In 1996, at the age of 27, Einhorn founded Greenlight Capital, a hedge fund that employs both long and short strategies. The fund started with a relatively small amount of capital but grew significantly over the years.

Einhorn gained early recognition for his astute analysis and investment strategies. He is known for short-selling Allied Capital in the early 2000s, exposing accounting irregularities and profiting from the company’s subsequent decline. Einhorn’s investment philosophy is rooted in value investing. He focuses on detailed fundamental analysis, seeking undervalued or overvalued stocks based on his assessments of a company’s financial health and prospects.

Einhorn is also known for his activism and shareholder advocacy. He has taken activist positions in various companies, pushing for changes in management or strategy to unlock shareholder value.

Greenlight Capital expanded its investments across different sectors, including technology, healthcare, and finance. Einhorn’s diversified approach contributes to the fund’s resilience in various market conditions. Einhorn authored the book “Fooling Some of the People All of the Time,” chronicling his experiences with Allied Capital. He is involved in philanthropy, supporting causes related to medical research and education.

While specific details about the funds raised in Einhorn’s 20s may not be publicly disclosed, Greenlight Capital has grown to become a well-known and respected hedge fund, managing substantial assets for institutional and individual investors. David Einhorn’s success with Greenlight Capital reflects his early talent in investment analysis and his ability to navigate markets effectively. The growth of the fund underscores his impact on the hedge fund industry.

Lesson Learned: Einhorn’s journey highlights the significance of value investing, shareholder activism, and the benefits of a diversified investment approach.

According to FORBES, his networth currently is valued below: related article

Read how a Ghanaian Client made GHS165,888.00 with only GHS5,000.00 (about $450).

READ story; CLICK HERE

Read how a Ghanaian trader made $8,000 (GHS 99,200) from a $300 (GHS 3,720) deposit.

Read story; Click here

Click image below to join our FOREX TRADING COMMUNITY

Traderjoshjoey on Instagram

Traderjoshjoey on Facebook

Disclaimer:

Thank you for reading our article. We want to make sure you understand a few important things:

- Informational Purpose: This article is for informational purposes only and is not personalized financial advice.

- Risk Awareness: Investing involves risks, and past performance is not a guarantee of future results. Be aware of the potential risks and uncertainties associated with financial decisions.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual circumstances.

- Educational Intent: Our aim is to provide educational content to help you make informed decisions. We encourage you to use this information as a tool for learning and understanding financial concepts.

- Your Decision: Ultimately, any decisions you make based on this information are your own responsibility.

Remember, knowledge is empowering. If you have questions or concerns, seeking advice from a financial professional is a smart step.

Thank you for your understanding.